At the beginning of every year, we set goals that we hope to reach by the end of the year. Below are the goals that we set for ourselves in early 2014 along with our results in achieving them.

1) Increase net worth to $251,900 – SUCCESS

At the start of 2014, we were less than $7K from reaching our 2014 net worth goal of $252K. Reaching it was almost a certainty, but I was still surprised when we blew past it in February, reaching a net worth of $274K that month.

2) Pass our 2015 Net Worth Goal 1 year early – SUCCESS

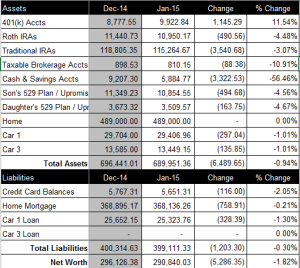

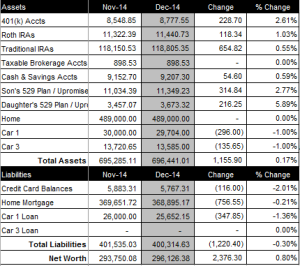

We are roughly 1 year ahead of our net worth goal targets, so it made sense to attempt to pass our 2015 net worth goal ($296K) one year early. It came down to the buzzer but we hit the goal. Actually, we passed our 2015 net worth goal briefly back in August, but lost ground shortly thereafter. It wasn’t until the last week of December that we passed our 2015 net worth goal again and ended the year with a net worth of $296,126.38.

3) Building savings account balance to $20,000 – FAIL

Every year that we attempt to reach the goal of$20k in savings, we fail. Sad and frustrating. We ended 2014 with $9,207.30 in savings. On a positive note, when I quit my job in September, we only had $7,720 in savings, so at least we haven’t had to dip into it yet.

4) Pay off Car 3 – SUCCESS

We started 2014 with a $12K balance on our “Car 3” auto loan (monthly payments of $307.21). We paid the vehicle off in February, thanks to a large quarterly bonus that my wife received.

5) Open 529 Plan for new baby – SUCCESS

We believe strongly in saving for our kid’s college and were happy to be able to reach this goal. Our daughter’s 529 Plan account was opened in June (1 month after her birth) with a initial deposit of $3K. Her 529 balance is now $3,673.32, not too shabby for a 8-month-old.

I will post our goals for 2015 shortly.