Overall

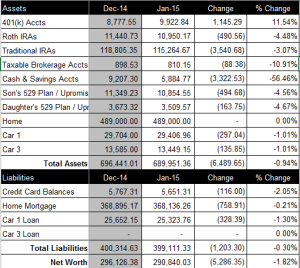

January was a down month for our net worth. It decreased $5,286.35, to a total of $290,840.03 (see spreadsheet screenshot). Not an awesome start to the year, but not the end of the world either. My wife just received a huge promotion so we’ll catch up in February.

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). We contributed $242.50 to my wife’s 401(k) and saw the total balance of our retirement accounts decrease $2,885.95 over last month to $136,137.68. In January, my wife also received her 3% company match ($1,012.52) for 2014.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s company) that has continued to decline as of late. Our balance is $810.15 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, due to a number of large annual bills, we had a decrease of $3,322.53 to our cash and savings bringing the total to $5,884.77.

College Savings Accounts

Our kids have 529 Plans through Vanguard. We contributed $0 to our son’s 529 Plan and it decreased $494.68 over last month to a total balance of $10,854.55. We contributed $0 to our daughter’s 529 Plan and it decreased $163.75 over last month to a total balance of $3,509.57.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $368,136.26. We paid $100 extra to mortgage principal this month.

Cars

“Car 1” is a 2011 SUV with 53K miles and “Car 3” is a 2004 SUV with 99K miles. We no longer own a “Car 2”. When calculating our net worth, we depreciate the vehicles 1% per month. Car 1 has a current loan balance of $25,323.76 and Car 3 is paid off.

Credit Card Balance

The $5,651.31 credit card balance is from a new HVAC that we installed in September 2014. It is 0% for two years. We expect to pay this off in February once my wife receives her quarterly bonus.

I’m looking at your 529 plans with interest as we currently are not saving for college and it’s just a few years away. How much do you normally contribute? Oh … and I want some bonuses like that;0)

I know it stunk to see the Net Worth go down but like you said its not the end of the world. Bummer on your wife’s stock going down. Hate it when that happens.

Side story: I was looking at some stocks (AT&T and Apple) to see how they are moving or not moving and my son comes in my office. He started asking a bunch of questions and seemed really interested. He actually asked for a few stocks for his birthday. Coolest money talk I have ever had with either of my kids.

Jayleen – In 2014, we contributed $3,365 to our daughter’s 529 and $965 to our son’s 529. In 2015, we hope to contribute $2,000 to each of their 529 Plans. We do not plan to cover 100% of the education costs, but hope to have a nice chuck for them when the time comes.

Demetrius – That’s cool your son is interested in investing! We plan to talk to our kids about investing when they are older and pray they want to hear it:)

Should you be counting your children’s college plans in your net worth?

Dave – The way we look at it is that the money for our kids’ college expenses is going to come from somewhere (investments, cash, 529 Plan, etc.). We would love to have it all be paid from the 529 Plans when the time comes, but realize that might not happen. In fact, with the rising costs of college, there is a good chance the money will come from multiple accounts. Including the 529 Plans in our net worth gives us a good picture of our total financial picture. Obviously, when we begin to withdraw from the 529 Plans, our net worth will be reduced, but that is true with any of the other accounts that we might pull funds from to pay college expenses.