We just passed our net worth milestones of $2,030,000 to $2,050,000! Our net worth is currently $2,053,453. We passed our last net worth milestone of $2,020,000 four days ago. We hope to reach our next milestone of $2,060,000 in a couple of months.

NET WORTH MILESTONES: $2,020K

We just passed our net worth milestone of$2,020,000! Our net worth is currently $2,022,062.71. We passed our last net worth milestone of $2,010,000 in March. We hope to reach our next milestone of $2,030,000 as early as next month.

September 2024 Income Statement

In September we had an amazing income month and an good expense month, relatively speaking.

Our total income this month was $24,826.84. In addition to my wife’s regular paychecks, she received a quarterly bonus of $19,507.50 gross ($12,204.98 net). We also received $163.99 in company reimbursements and $56.20 in interest income from our savings accounts.

This month, our expenses totaled $14,949.39. Large expenses included $3,531.70 for groceries/dining, $2,378.10 for giving, and $970.08 for pet care/pet insurance.

Next month should be a relatively typical income and expense month.

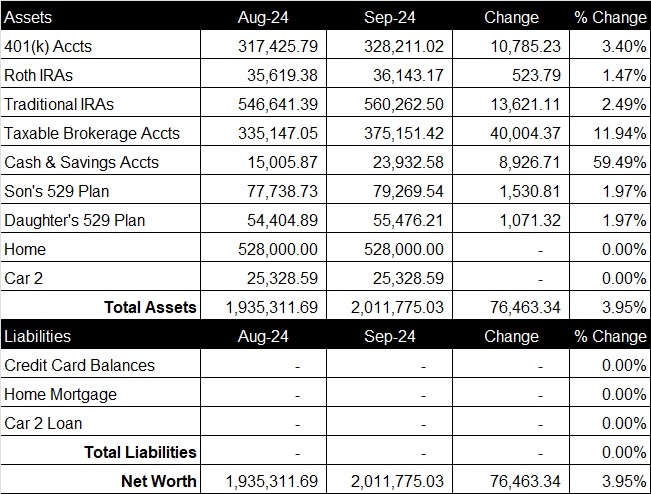

September 2024 Net Worth Update (+76,463.34)

Overall

In September, our net worth increased $76,463.34 from last month to a total of $2,011,775.03 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. My Wife contributes 6% to her 401(k) and her company matches 4% and chips in an additional 6% at the end of the year. Her 401(k) increases 1% automatically in March every year. This month, she contributed $1,998.14 to her 401(k). I do not work and do not contribute to a retirement account any longer. The total balance of our retirement accounts increased $24,930.13 from last month to a total of $924,616.69.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $375,151.42, up $40,004.37 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $8,926.71 this month to a total of $23,932.58.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $1,530.81 from last month to a total balance of $79,269.54. We contributed $0 to our daughter’s 529 Plan and it increased $1,071.32 from last month to a total balance of $55,476.21. Our total 2024 contributions so far are $4,000 for our son and $4,000 for our daughter. Our goal for the year was $8,000 total ($4K each) into our kids’ 529 Plans and we reached our goal with time to spare.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$924K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~105K miles on odometer) that we own (no auto loan).

Credit Card Balance

All of our credit card debt is paid in full each month.

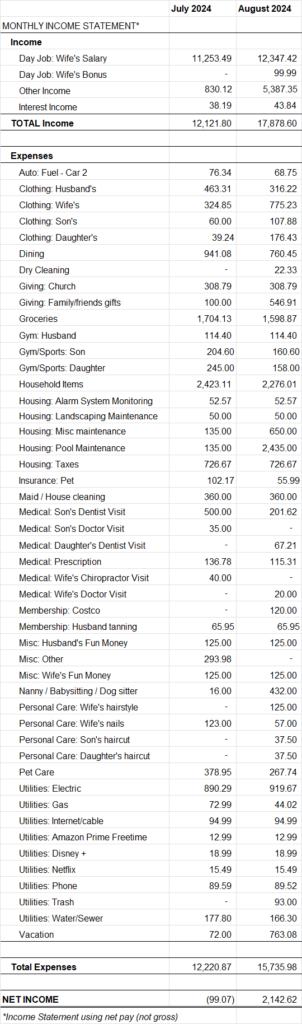

August 2024 Income Statement

In August, we had a excellent income month and an okay expense month.

Our total income this month was $17,878.60. In addition to my wife’s regular paychecks, she sold some company stock for $9,018.84 gross ($5,287.36 net). She also received $99.99 in company reimbursements and we earned $43.84 in interest income from our savings accounts.

This month, our expenses totaled $15,735.98. Large expenses included $1,375.76 for clothing, $546.91 for gifts, and $763.08 for vacation.

Next month my wife will receive a quarterly bonus of $19,507.50 gross.

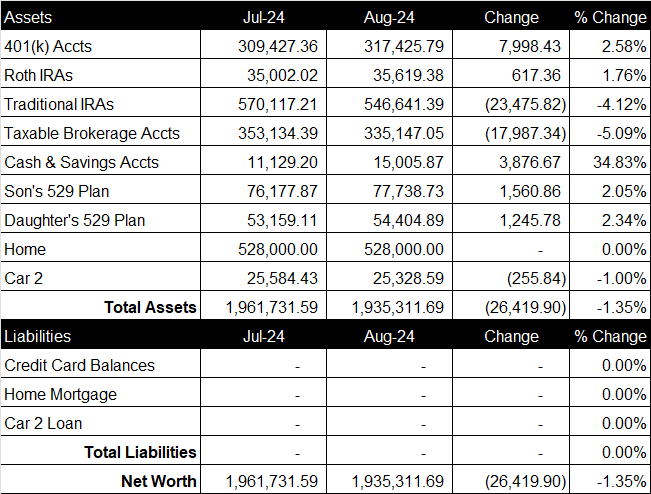

August 2024 Net Worth Update (-26,419.90)

Overall

In August, our net worth decreased $26,419.90 from last month to a total of $1,935,311.69 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. My Wife contributes 6% to her 401(k) and her company matches 4% and chips in an additional 6% at the end of the year. Her 401(k) increases 1% automatically in March every year. This month, she contributed $1,022.76 to her 401(k). I do not work and do not contribute to a retirement account any longer. The total balance of our retirement accounts decreased $14,860.03 from last month to a total of $899,686.56.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $335,147.05, down $17,987.34 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $3,876.67 this month to a total of $15,005.87.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $500 to our son’s 529 Plan and it increased $1,560.86 from last month to a total balance of $77,738.73. We contributed $500 to our daughter’s 529 Plan and it increased $1,245.78 from last month to a total balance of $54,404.89. Our total 2024 contributions so far are $4,000 for our son and $4,000 for our daughter. This means we hit our 529 Plan contribution goal for the year ($8,000 total) with 4 months to spare.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$938K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~100K miles on odometer) that we own (no auto loan).

Credit Card Balance

All of our credit card debt is paid in full each month.

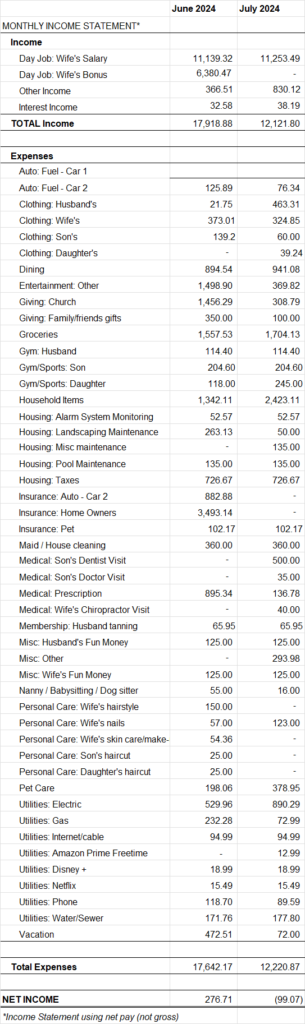

July 2024 Income Statement

In July, we had a great income month and a pretty reasonable expense month.

Our total income this month was $12,121.80. In addition to my wife’s regular paychecks, she sold company stock for 970.84 gross ($552.05 net). We also received a $166 insurance check and $38.19 in interest income from our savings accounts.

This month, our expenses totaled $12,220.87. Large expenses included $2,300 for a new pool filter, $887.40 for clothing, and $500 for downpayment on braces (we are financing the balance for 12 months at 0%).

Next month my wife should be able to sell more of her company stock.

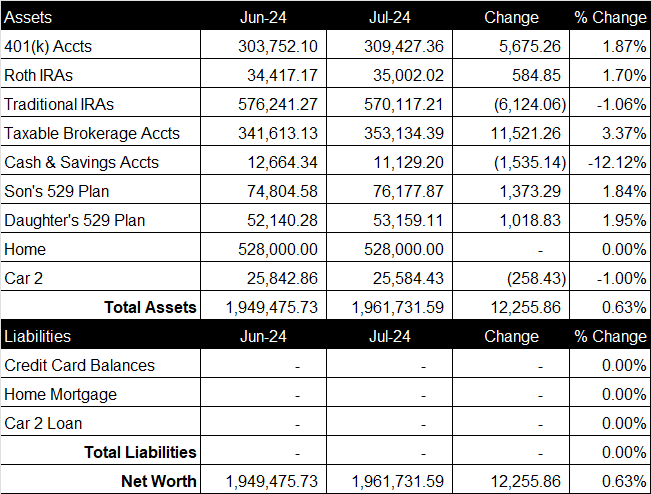

July 2024 Net Worth Update (+12,255.86)

Overall

In July, our net worth increased $12,255.86 from last month to a total of $1,961,731.59 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We reduced my Wife’s 401(k) contribution from 8% to 6% to help with our cash flow and her company matches 4% and chips in an additional 6% at the end of the year. Her 401(k) increases 1% automatically in March every year. This month, she contributed $1,193.22 to her 401(k). I do not work and do not contribute to a retirement account any longer. The total balance of our retirement accounts increased $136.05 from last month to a total of $914,546.59.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $353,134.39, up $11,521.26 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings decreased $1,535.14 this month to a total of $11,129.20.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $200 to our son’s 529 Plan and it increased $1,373.29 from last month to a total balance of $76,177.87. We contributed $200 to our daughter’s 529 Plan and it increased $1,018.83 from last month to a total balance of $53,159.22. Our total 2024 contributions so far are $3,500 for our son and $3,500 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$930K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~100K miles on odometer) that we own (no car loan).

Credit Card Balance

All of our credit card debt is paid in full each month.

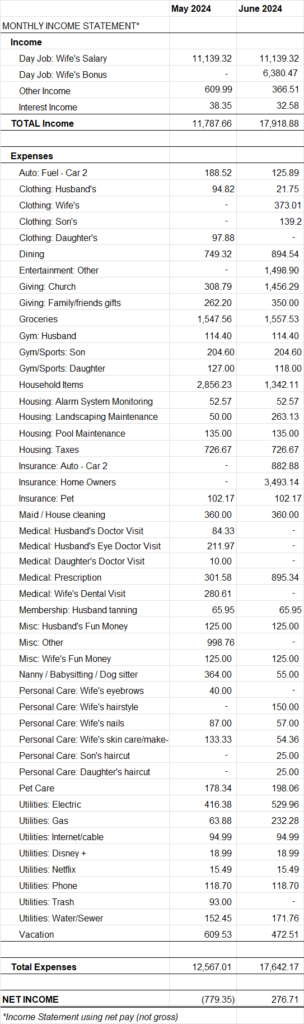

June 2024 Income Statement

In June, we had a great income month but also a high expense month.

Our total income this month was $17,918.88. In addition to my wife’s regular paychecks, she received a $11,475 gross ($6,380.47 net) quarterly bonus. We also received $366.51 in auto insurance refunds and $32.58 in interest income from our savings accounts.

This month, our expenses totaled $17,642.17 (just $276.71 less than our income). Large expenses included $4,478.19 in insurance costs, $1498.90 in entertainment, and $472.51 in vacation costs.

Next month my wife should be able to sell some of my wife’s company stock for ~$6,000 gross.

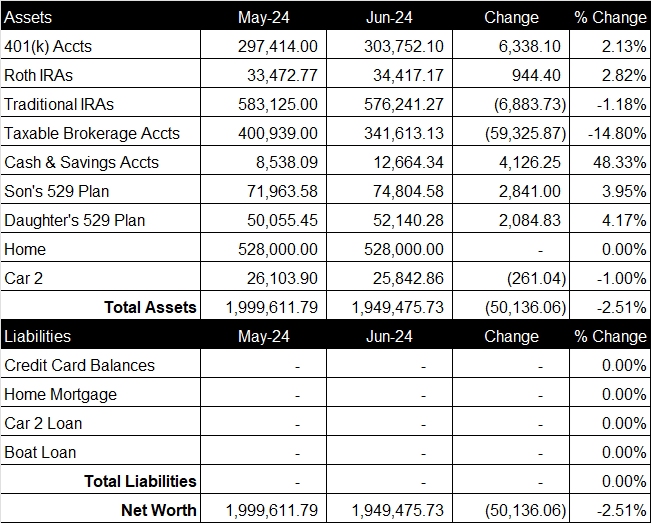

June 2024 Net Worth Update (-50,136.06)

Overall

In June, our net worth decreased $50,136.06 from last month to a total of $1,949,475.73 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 8% (increases 1% automatically in March every year) to my wife’s 401(k) and her company matched 4% and chips in an additional 6% at the end of the year. This month, she contributed $1,937.43 to her 401(k). I do not work, nor contribute to a retirement account. The total balance of our retirement accounts increased $398.77 from last month to a total of $914,410.54.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $341,613.13, down $59,325.87 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $4,126.25 this month to a total of $12,664.34.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $200 to our son’s 529 Plan and it increased $2,841.00 from last month to a total balance of $74,804.58. We contributed $200 to our daughter’s 529 Plan and it increased $2,084.83 from last month to a total balance of $52,140.28. Our total 2024 contributions so far are $3,300 for our son and $3,300 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$933K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~100K miles on odometer) that we own (no car loan).

Credit Card Balance

All of our credit card debt is paid in full each month.