With the new year approaching, I decided to change the format of our monthly net worth updates. The spreadsheet layout will stay the same for easy comparison to previous months, but the detail in the blog post will change. I am replacing my typical “What Worked”, “What Didn’t Work”, and “Next Month” sections with more detailed information on each line item on the spreadsheet.

Overall

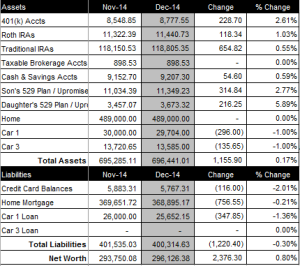

Overall, December was an okay month for our net worth. It increased $2,376.30, to a total of $296,126.38 (see spreadsheet screenshot). It might not be a huge increase, but it was enough to get us past our 2015 net worth goal of $296K one year ahead of schedule!

Retirement Accounts

Our retirement accounts are comprised of my wife’s 401(k), our Roth IRAs and our Traditional IRAs. My wife’s company matches up to 3% of her 401(K) contribution and deposits the sum once a year on January 1st (it is 100% vested when deposited). In December, we contributed $242.50 to my wife’s 401(k) and saw the total balance of our retirement accounts increase $1,001.86 over last month to $139,023.63.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month, we had a tiny increase of $54.60 to our cash and savings bringing the total to $9,207.30.

College Savings Accounts

Our kids have 529 Plans through Vanguard. We contributed $165 to our son’s 529 Plan and it increased $314.84 over last month to a total balance of $11,349.23. We also contributed $165 to our daughter’s 529 Plan and it increased $216.25 over last month to a total balance of $3,673.32.

Home

We use the $489K purchase price that we paid in January 2012 for our home value. Current comps in the area are ~$650K. The current balance on our mortgage loan is $368,895.17. We paid $100 extra to mortgage principal this month.

Cars

“Car 1” is a 2011 SUV with 53K miles and “Car 3” is a 2004 SUV with 99K miles. We no longer own a “Car 2”. When calculating our net worth, we depreciate the vehicles 1% per month. Car 1 has a current loan balance of $25,652.15 and Car 3 is paid off.

Credit Card Balance

The $5,767.31 credit card balance is from a new HVAC that we installed in September 2014. It is 0% for two years.