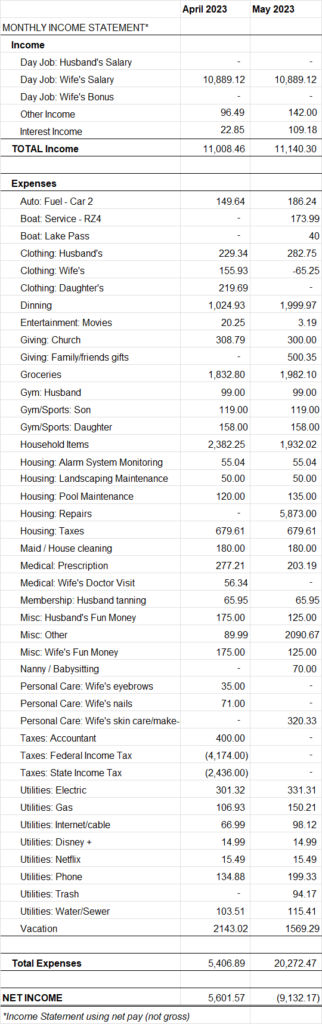

In May, we had a regular income month and a very high expense month.

Our total income in May was $11,140.30. In addition to my wife’s regular paychecks, she received $0 in company reimbursements for internet (she will get double next month). We also earned $109.18 in interest income from our savings accounts. We sold our 2013 ski boat this month for $65,000.

This month, our expenses totaled a whopping $20,272.47. Large expenses included $5,873 for home maintenance, $1,755 for a new purse (added to Misc bucket), and $1,569.29 for vacations.

In June, my wife should receive her quarterly bonus of ~$10,000 gross.