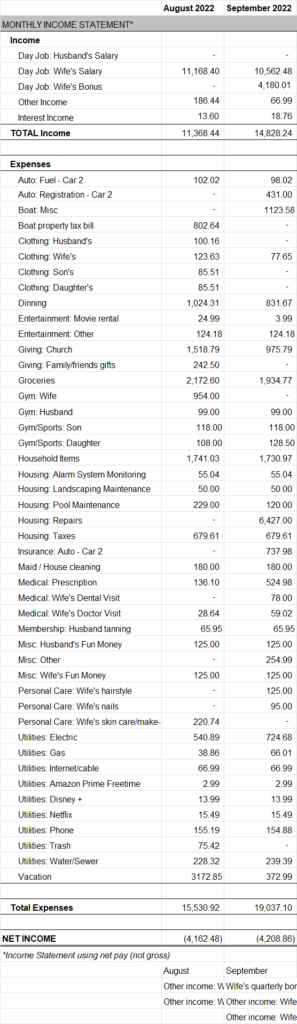

In September, we had a great income month and but also a very high expense month.

Our total income in September was $14,828.24 In addition to my wife’s regular paychecks, she received $66.99 in company reimbursements for internet. We also earned $18.76 in interest income from our savings accounts.

This month, our expenses totaled $19,037.10. Large expenses included $6,427 for window shutters, $1,123 in boat repairs, in vacation expenses, and $372.99 for clothing.

Next month, we have a $707 boat insurance bill due.

I really enjoy that you share everything in such detail. Thank you for that! A few questions:

Almost every month seems to be a “high” expense month in one way or another when you report it. Doesn’t that make it an average expense month?

Also, you don’t seem to be concerned about running a deficit with such high spending. Is there something else in the picture (inheritance, etc) which makes you comfortable?

Lastly, what does the category of household items include?

Thanks again!

Thank you for the comment!

Your point about our high expense months is fair. My justification for calling them “high” expense months is that they are high relative to our target of $10K/month.

Most of our expenses are charged to our credit cards in order to maximize our rewards. I note them on our income statement in the month they post to our credit cards online, however, we may not actually pay that particular credit card bill until the following month when it is due. This float helps our cash flow but can make the income statements a little wonky when we use cash from the next month to pay off a charge from this month. If that’s not confusing enough, I will also prepay bills sometimes if we have a good income month. For example, our $802 boat property tax bill was due in August, but I actually paid it in July since we had a surplus of cash. Unlike our credit card charges that I add to our income statement in the month they post to our credit cards online, bills paid with cash I do not add to the income statement until the month they are due. Weird, I know, but it helps me when I look back on previous years to be able to quickly see our boat property tax bill each August.

Household is a catch all for items that do not fall into any of my other categories. Stuff like cleaning/grooming supplies, paper products, school items, supplements, kids’ toys, batteries, etc. It has grown to such a large number that I should break out some of the larger purchases into their own category but just haven’t had the time.

Thanks for reading!