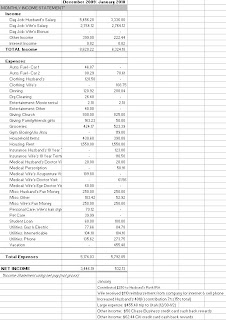

September was a good month for our income and expenses (see spreadsheet below).

In addition to our paychecks, my wife received a $500 gross ($280.10 net) special bonus and $75 reimbursement from her company for internet and cell phone. We also received a $100 in cash back rewards from our credit cards and an $89.63 auto insurance refund. Not too shabby.

Expenses were more or less in-line with our budget. We each got $140 in extra fun money (we’ve been doing that a lot lately), my wife went on a trip with her friends / family, we bought a few things for the Jeep, and we’ve purchased ~$250 in items for a camping trip we are taking in October.

October seems like it might be a pretty normal month. No large bills are looming and our income should be average.