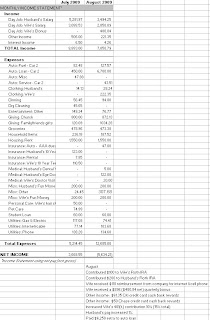

May was a strong income month and a reasonable expense month.

May was my Wife’s 1st full month at her new company and, thus, her 1st full months of paychecks at new new higher salary. We were also bless with my 2.5% salary increase kicking in at the beginning of May. In addition to our paychecks, my wife received a $1,884.50 gross ($1,055.71 net) bonus from her old company, a final $430 unemployment arrived, we received $100 in cash back credit card rewards, and $18.39 in rebates. Not too shabby.

Our expenses were pretty typical; we spent a total of $5,401.88. Auto, clothing, and gifts were higher than usual, but not too outrageous.

I’m not sure what to expect in June. I receive a 3rd “extra” check, but we also have a $1,906.90 in annual insurance premiums due at the end of June. Time will tell.