In addition to our regular paychecks, I sold back 4 days of vacation to my company for $870.43 We also earned $225 in cash back rewards, sold our 15 shares of Toyota stock for $260.52 gain, and my wife received a $30.00 reimbursement from her company. The interest income of our E*TRADE savings account was $26.24.Next month, my wife should receive her quarterly bonus of at least $1,500 and I will be receiving a 3rd “extra” paycheck next month. Both will be deposited into savings. My wife should find out in mid December if her position will be eliminated at her company. If so, her last day will likely be December 31st. Because of this, we plan to keep our Christmas expenses down this year.

Category Archives: Income Statement

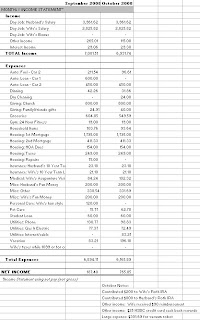

October 2008 Income Statement

While our net worth in October dropped considerably, our expenses for the month were pretty low (click on spreadsheet below). We spent a total of $ 6,165.89, which is good, especially considering we splurged on a $301.69 vacuum robot and a $196.18 hotel room for my wife while she was in Vegas.

Our incomes this month were pretty standard. In addition to our paychecks, my wife received a $90.00 reimbursement from her company and we earned a $25 cash reward from our HSBC credit card. The interest income of our E*TRADE savings account was $29.30.

Next month, our incomes will be standard but we have some large expesnses: a $1,157 annual auto insurance bill, $439 condo insurance bill, and a $1,169.14 property tax bill. We plan to cash in 5 of my vacation days to cover most of the two annual insurance bills and pull money out of savings to pay the property tax bill. Some of our other expenses should be lighter next month because I will be out of town ½ of the month.

September 2009 Income Statement

While our net worth dropped $3,310.51 in September, we nevertheless did a good job of keeping our expenses down (click on spreadsheet).

Our total expenses were $6,894.11, surprisingly low considering we purchased a new table and chairs ($329), paid off the balance of Car 1 so we could sell it ($600), and had to have some plumbing work done ($75).

In addition to our regular paychecks, we were able to pull in other income of $265.01 this month from two credit card rewards, a small refund check, and my wife’s reimbursement. Our interest income for September was $29.06.

Next month should be a low expense month since I will be on business travel for two weeks.

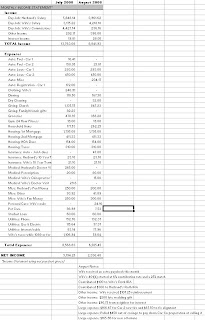

August 2008 Income Statement

August was our 2nd lowest month of expenses in this year (click on spreadsheet below). My wife was out of town 2-1/2 weeks for business and I was out of town 1 week for business; all of this business travel helped save us some money. While my wife was out of town, I was able to use her company car and gas card, saving us $125-$150 in gas.

We had another strong income month, which is especially nice when combined with a low expense month. My wife earned an “extra” third check this month as well as a $236.16 commission from her old company. We also received a $200 wedding gift that was totally unexpected, but appreciated, since we have been married a couple of years. With our savings account balance rising, we’re starting to see an increase in interest income; this month we earned $28.05 in interest income.

Next month my wife may receive her 1st quarterly bonus, although if she receives anything, it will be a much smaller bonus than what she can expect down the road. We should also earn cash rewards from our Citi credit card and HSBC credit card. The only major expense planned is a few hundred dollars for a new kitchen table and chairs.

July 2008 Income Statement

In addition to this great income month, we were able to keep our expenses pretty well inline. I cost us a $250 because I hurt my ear and have to have surgery. Our phone bill also jumped up because we added a phone for my wife with many minutes because she needs it for work. Thankfully, her company reimburses her $60/month for a cell phone, so most of the added costs are covered. Our gas & electric bill jumped over 40% because we have been using our air conditioning quite a bit (my fault). I’m going to be more careful with running it only when needed.

In August, my wife will receive a third “extra” check and possibly even another small commission check from her old company. My wife will also be out of town for a 2-1/2 week training program. While she is gone, I get to drive her company car and save gas money.

June 2008 Income Statement

Not only was June the 2nd month yet in which our net worth decreased, it was also our 2nd largest month of expenses (click on spreadsheet below). The only month our expenses were greater was in November 2007, when they totaled $9176.12.

We spent a total of $8,610.66 in June, but our income was only $6,324.00. Obviously, we do not want to make a habit of this, even if we did make enough money to support it. Large expenses included $1,071.09 for our vacation at the end of May (bill was due in June), $407.76 on gifts, $301.42 on household items, $187.69 eating out, and $104 on my eye exam and contacts.

My wife’s income in June was a bit less because of the transition to her new job – her first check in July will be for three weeks of work. She earned a nice $519.12 commission check during her last month with her old company. We also earned $109.79 in mileage reimbursements, $74.83 in Citi credit card rewards, and $13.26 in interest income.

God willing, we will substantially reduce our expenses in July. Incomewise, we should have a great month. My wife will receive her first paycheck from her better paying new job, I receive an “extra” third check, and my wife may receive a large ~$3,800 commission from her old company.

May 2008 Income Statement

I wish we could have kept our expenses at the same level as last month, but it didn’t happen. We spent a good amount of money in May, but thankfully, we earned much more (click on spreadsheet below).

In addition to our regular saleries, my wife received an “extra” paycheck, a $943.92 commission check, and a $89.10 mileage reimbursement check.

Outside of our jobs, we earned a $50 Chase credit card cash back reward, $25 HSBC credit card reward, and our $1,200 economic stimulus check. Our E*TRADE savings account brought in $14.98 in interest income.

Next month should be a interesting. My wife will be leaving her current job and starting her new career. We’re still not sure of the paycheck timing at her new job so we may end up with a bit less money coming in in June. We also have to pay for our $1019.81 vacation that we took at the end of May.

April 2008 Income Statement

We did a great job of staying within our budget this month (click on spreadsheet below). In fact, this is the least amount of money we have spent in quite awhile, which is great after last month.

One of the few areas we went over budget was $222.30 in our Entertainment category because we had a couple of nights out with friends celebrating their birthdays. Incomewise, I received a 2.07% raise. My wife earned $466.91 in commissions and $40.80 in reimbursements. We also received a $66.65 cash back reward from our Citi credit card and a $50 gift card to a restaurant from our American Express. We earned interest income of $12.10.

May should be a another great income month. My wife gets 3 paychecks next month (extra one going to savings) and hopefully a ~$700 commission check. We possibly should also receive our $1,200 tax rebate which will be apllied to our Roth IRAs. Our expenses will be a bit higher because we have a week long vacation up the coast planned.

March 2008 Income Statement

It’s scary sometimes how much we can spend in one month (click on spreadsheet below).

Thank God for the extra money we brought in above our standard income. The largest amount of money was brought in by my Wife’s in the form of a $1,292.50 commission check and a $188.54 mileage reimbursement check. We also received a $384.44 property tax refund, $60 from my parents, and $60 from selling a few things. All of this extra money kept us from spending more than we earned in March.

Needless to say, we went over budget in most areas. Some of the larger expenses were $832.46 for household items (including a new home theater system), $585.67 for groceries, $129.01 for pet care (including pet care while our condo was being worked on), and $166.00 for car registration.

We have vowed to spead less in April. My Wife may get good commission check in April and I have a review that may result in a small raise.

February 2008 Income Statement

Wow, we went over budget in almost ever category this month (click on spreadsheet below). Income taxes, vaccines for our dog, food/drinks for a party, gifts, carpet cleaning, replacing our entertainment stand, eating out for our birthdays and Valentine’s Day. You name it we did it.

Thankfully, we had some extra income this month. My wife earned a $59.50 commission, I cashed out $1,239.53 of my company vacation, we earned a $25 HSBC credit card reward, and our neighbor paid us $96 for 6 months of internet.

Next month, in addition to our standard monthly income, my wife may earn an extra ~$1,000 commission from her company. This would help us fund our Roth IRAs. Expensewise, we have a large property tax bill due that will ding our savings pretty good.