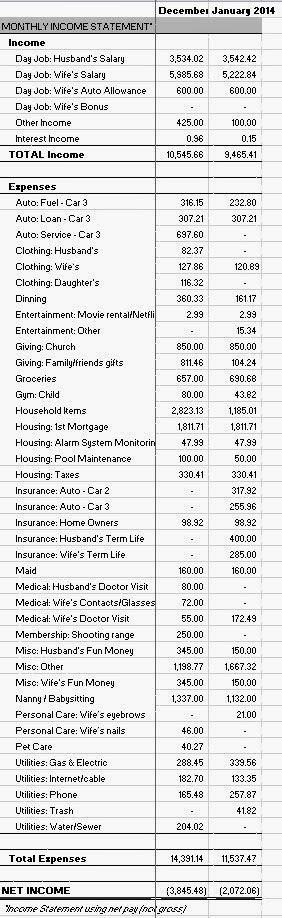

Our total income in September was $13,739.35. In addition to our regular paychecks, I received $2,049.71 PTO payout and last weeks pay. My wife’s company paid her an $800 auto allowance and a $100 company reimbursement for internet service. We also received $95 from Verizon and a $30 for our daughter’s 529 Plan. We earned $5.38 in interest income from our online savings account.

am very interested to see if we can dramatically reduce our expenses in October. My wife’s net income each month is $6,300.28 plus an additional $900.00 for auto allowance and internet service. So, $7,200 or less is the goal.