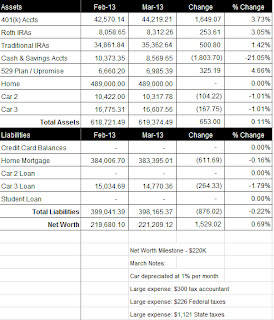

Another good net worth increase month considering my wife is unemployed. Our net worth increased $1,529.02 from last month, to a total of $221,209.12 (click on spreadsheet below).

We contributed a total of $818.88 to our retirement accounts and saw them increase $2,403.48 to $87,894.11 total. Thanks to using Upromise.com to book my business travel, we’re slowly increasing my son’s college savings. In late breaking news, my wife has just accepted a new job paying $83,000 a year with great benefits, such as a company car.

What Didn’t Work

We had to pay $226 in Federal income taxes and $1,121 in State income taxes. As a result, we had to dip into savings a bit.

Next Month

My wife begins a new job April 8th!!! We have a number of bills coming due in April, so it will be a tight month.

.bmp)