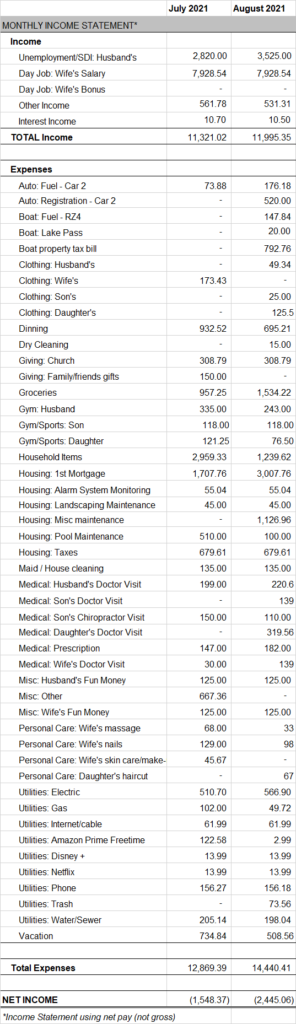

In August, we had a good income month and an okay expense month (compared to our monthly average).

Our total income in August was $11,995.35. In addition to my wife’s regular paychecks, she received $198.31 in company reimbursements for internet. I received $3,525 in unemployment benefits. We also received $333 in child tax credits from the IRS. We earned $10.50 in interest income from our savings accounts.

This month, our expenses totaled $14,440.41. Large, non-recurring expenses included $1,126.96 for a new washing machine, $1,110.16 for medical/prescriptions and $508.56 for vacation expenses.

Next month, my unemployment checks may end but, more importantly, we will be paying off our home mortgage!