I will be on a business trip in Europe next week, so my boss took me to lunch today to let me know that our company will be laying off 6 employees next Friday. We’re a small company, so this represents 15% of our employees. They are basically cutting one employee from each department. I did not find out who will be let go, but was assured it won’t be me or my sales representative.

To survive during this tough economic time, my company is going to continue to dramatically reduce expenses. The Owner of the company has recently quit taking a paycheck, and my boss and our controller took a 20% reduction in pay. If things keep getting worse, my company may move to a 4 day work week and ask all employees to take a 20% cut in pay. Quite frankly, I’d much prefer that to loosing my job.

I feel bad knowing that some of my co-workers/friends are going to be out of a job next week. I thank God that I made it thru this first cut and hope my company is able to get through these tough times.

On a related note, my wife’s company will be having a big shake-up in December. Her boss, who has been with the company 23 years, has already been informed that his position will no longer exist. He was able to find a rep position to move to in the company in December, but new employees, like my wife, won’t know where they stand until December.

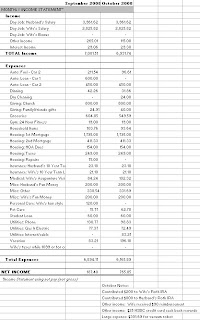

These are scary times. In addition to praying for our companies and jobs, we’ve cut expenses and tried to bolster our savings. It looks like we should plan to tighten our belts a bit further.