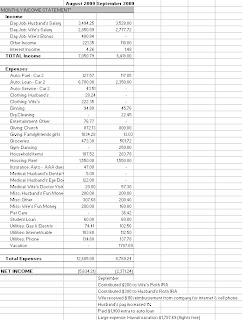

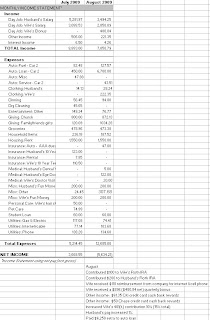

We had a pretty average income and expense month in September (click on spreadsheet below).

Our largest expense for the month was our amazing 6 day vacation to

Here’s a breakdown of our vacation costs:

Flights: Free thanks to frequent flyer miles

Hotel: $773.70 (wife found a good deal)

Rental Car: $244.55 (wife found a good deal)

Food & Entertainment: $769.44

Other large expenses for September include an extra $1,900 payment to our auto loan and $116.75 at the shooting range.

Our income for the month consisted of our regular salaries and my wife’s $110 company reimbursement. My company bumped everyone’s salaries up again, resulting in another 1% increase to my salary (it was also increased 1% last month). We also earned $1.48 in interest income from our online savings account.

Next month, there are no large expenses planned, other than continuing to pay down our auto loan at an accelerated rate with a goal of having it paid off by the end of the year.