My wife found out yesterday at 30% of her company received an email that morning explaining they were laid off. We feel terrible for her coworkers that were laid off, especially right before Christmas.

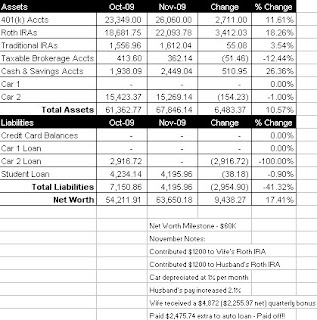

Thankfully, my wife kept her job, but it was certainly a wake up call. So, I ran through the numbers to see how we would have been affected if she would have been part of the lay off.

The 1st negative impact would have been losing the $2,770/month income she takes home and her quarterly bonuses. Next, would be her company car and $110/month in cell phone and internet reimbursements. Finally, she’d lose her insurance and 401(k) plan (which she contributes 15% to).

We took a look back at what unemployment paid her before she found her current job. I was surprised it was a little over $400/week after taxes. That more than I remembered and supplements ~60% of her regular paychecks. Cutting back a bit on our retirement contributions and unnecessary spending would make up the difference. Losing the company car would be tough, but since we just paid off our $450/month auto loan, we’re in a better position that ever to take on another (small) auto loan, if necessary. Health isurance is very important, and since my wife is young and healthy, she easily qualifies for good health insurance that only costs $80/month.

Working through this drill was reassuring. Should her company do another lay off in a few months, and if she is let go, we should be fine. One possible wrench is my job. Sales are starting to soften a bit at my company, but we’re introducing innovative new products in February that should increase sales. Worst case scenario, I believe I’d be keep on until at least May. In the meantime, we’ll start socking away cash for added security. And of course, say our prayers.