Great news! We just passed our 2011 net worth goal of $138,100. That puts us 8 months ahead of schedule. This should allow us to gain some serious ground on our 2012 net worth goal of $173,200. I will update our net worth meter (on left) at the end of the month.

March 2011 Income Statement

As expected, March was a “spendy” month and a relatively standard income (click on spreadsheet below).

In addition to our paychecks, my wife received two $75 company reimbursements (Feb & March) and we earned $125 in credit card rewards We also earned $15.47 in interest income from our savings.

Our expenses totaled a whopping $11,033.55! Some of the larger items were: $2,954.60 for paying off the student loan, $346 registration for cars, $205.40 flight to see family, $119.42 hotel, $523 pet care (vet), and a lot on “nesting” for our baby.

April should be a very good income month. In addition to my wife starting her new job, she also receives gets paid for her remaining vacation time (5 days). Plus, we will receive a combined Federal and State refund of $2,325. No large expenses are forecast for April.

March 2011 Net Worth Update (+$3,607.99)

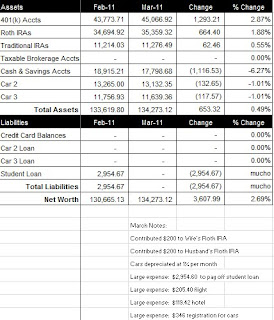

March was another solid month. Our net worth increased $3,607.99 from last month, to a total of $134,273.12 (click on spreadsheet below).

What Worked The big news this month is that we found out that our baby is a BOY! We are very excited. Financially, we were also hugely blessed because my wife accepted a new job that starts next month with a $20,000 higher annual salary (33% increase). She also has an opportunity to make a larger bonus each quarter. I am very proud of her. This is going to really help us reach our goals. To celebrate, we paid off the last of the $2,954.60 student loan. We are now completely DEBT FREE. We contributed $1,213.00 to our retirement accounts and saw them increase $2,020.07 to $91,702.73.

What Didn’t Work Not really a negative, but our savings account balance decreased because we paid off the student loans.

Next Month There is a good chance we will pass our 2011 net worth goal of $138,100 in April, 8 months ahead of schedule. My receives her final paycheck from her old company, gets paid for her remaining vacation time, and starts her new job. We also receive a combined Federal and State refund of $2,325.

February 2011 Income Statement

As I mentioned in our February Net Worth Update post, we were blessed to learn that my wife is pregnant. Our expenses are going to be higher than usual as we prepare for the new arrival (due in September). February was an outstanding income month and we did a pretty reasonable job managing our expenses (click on spreadsheet below).

Our total income in February was $10,614.56. In addition to our paychecks, my wife received a Q4 2010 bonus of $6,041.28 gross ($3,499.51 net). She received a $30.78 H.S.A. reimbursement and a $50 Chase credit card reward (her $75 company reimbursement for February will come next month). We also earned $15.11 in interest income.

Our total expenses were $5,394.78, not to much higher than our budget of $4,900. As first-time parents, we’ve been buying a few things for the baby’s room and also taking time to enjoy ourselves a little more while we have free time.

It’s hard to say what March may bring. My wife’s company may be doing raises in March, which would be icing on the cake for how well she is doing. We’ll be doing our taxes as well and I don’t have a clear picture at this time on what the outcome will be.

February 2011 Net Worth Update (+$10,191.88)

We were blessed with our 2nd largest net worth increase month ever. Our net worth increased $10,191.88 from last month, to a total of $130,665.13 (click on spreadsheet below). Our largest net worth increase of $14,753.11 was in March 2010. But more importantly, my wife is pregnant! We are extremely excited and will be “nesting” from now until the baby is due in September.

What Worked

In addition to the great news that my wife is pregnant, we also passed the net worth milestone $130,000 in February. This is largely thanks to my wife’s nice Q4 2010 bonus of $6,041.28 gross ($3,499.51 net). We contributed $813.00 to our retirement accounts and saw them increase $4,605.31 to $89,682.66. We also increased our savings account balance to $18,915.21.

What Didn’t Work

February was a perfect month.

Next Month

I don’t expect March to be able to compete with a month like we just had. The biggest unknown is our taxes. Last year we received a combines Federal and State refund of $4,111, but we have change a few things to reduce or possibly eliminate our refund. We will see…

Net Worth Milestone – $130,000

Today we passed the $130,000 net worth milestone!

We passed our last milestone of $120K, in January. Based on my forecasts, we should hit the next net worth milestone of $140K around June.

I will update our net worth meter (on the left side of the screen) at the end of the month.

2010 Net Worth Recap

I know I’m posting this a little late, but I wanted to take the time to review our 2010 net worth. Below is a table of our net worth data for each month in 2010 (click on table to enlarge). 2010 was a strong year for us, even though we had a couple of close calls with the economy in terms of our employment. Some highlights from 2010 include:

- We increased our net worth from $68,437.63 to $115,300.07 ($46,862.44 increase), surpassing our net worth goal for the year by $9,600.07.

- We contributed $17,288.45 to our retirement accounts. Our total retirement account balance grew from $54,620.37 to $83,594.59 ($28,974.22 increase).

- We increased our savings from $2,492.73 to $9,215.82 ($6,723.09 increase).

- We reduced our debt from $4,148.46 to $3,127.35 ($1,021.11 decrease).

- In March my wife was laid off, but in April she found an even better new job.

- I survived a large layoff at my company.

- We paid cash for an “extra” vehicle, primarily for recreation.

We already a couple of months into 2011 and things are looking great. Hopefully there will be exciting highlights to review at the end of the year.

January 2011 Income Statement

Thankfully, we made up some lost ground in January (click on spreadsheet below).

In addition to our paychecks, my wife also received $150 reimbursement from her company for cell phone for December and January. We earned a $175 Chase credit card reward and $50 from selling dog stuff on craigslist. As our savings account balance creeps up, we’re earning more interest income to the tune of $11.06 in January.

We worked hard in January to control our spending and it worked. After a HUGE expense month in December ($7,919.80), we righted the ship in January, only spending $5,591.83. Now we need to carry this momentum into February.

Next month is going to be a big income month. My wife is doing awesome in her job and, as a result, is receiving a Q4 bonus of $6,041.28 gross. Plus, we do not have any large expenses forecast for February.

January 2011Net Worth Update (+$5,173.19)

We had a solid increase start to 2011 in terms of our new worth. Our net worth increased $5,173.19 from last month, to a total of $120,473.25 (click on spreadsheet below).

What WorkedWe contributed $813.00 to our retirement accounts and saw them increase $1,482.76 to $85,077.35. We also dramatically increased our savings account balance by substantially.

What Didn’t Work

Everything worked out great :)!

Next Month

February looks like it is shaping up to be a great month. The main reason being, my wife made 120% of her sales goal for Q4 and will be getting a large bonus check. We’re going to use this extra money to continue increasing our savings.

Net Worth Milestone – $120,000

Today we passed the $120,000 net worth milestone!

We passed our last milestone of $110K, in December. Based on my forecasts, we should hit the next net worth milestone of $130K around May.

I will update our net worth meter (on the left side of the screen) at the end of the month.