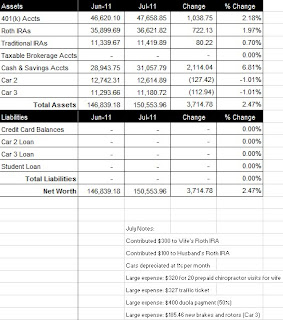

We had another very good income month in July ($9,800.70 total), however, we also had a higher than average expense month ($6,975.51 total) (click on spreadsheet below).

In addition to our regular paychecks, my wife received a third “extra” check in July and a $25 reimbursement from her company for internet. We earned $25.00 in credit card cash back rewards. We also earned $23.04 in interest income from our online savings account.

Our expenses lower than June, but still high, totaling $6,975.51. This included a number of large bills: $400 for a 50% payment to our doula, $327 for a traffic ticket, $320 for 20 prepaid chiropractor visits, $233.50 for life insurance, $213.48 for clothing, and $185 for new brakes.

August should be a pretty standard income month, but may be an above average expense month because we have purchases for the baby, including possibly $1,800 after discount cord blood bank.