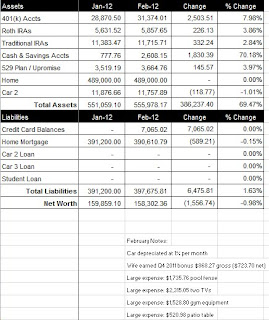

We barely squeaked by with an increase to our net worth this month, but we’ll happily take it. Our net worth increased $992.69 from last month, to a total of $189,253.96 (click on spreadsheet below). This puts us at 109.27% of our 2012 net worth goal of $173,200.

We continue to pay our auto loan a week or two early so that more of our payment goes to principle ($264 principle reduction this month instead of ~$200).

We passed the net worth milestone of $190,000 earlier this month only to see the market retract and drop us down below it again. We contributed a total of $1,854.48 to our retirement accounts but only saw them increase $968.85 to $65,231.77 total.

Next month my wife receives a third “extra” paycheck and may earn ~$8K gross quarterly bonus. We plan to put a large portion into savings and also contribute ~$1,500 to our son’s 529 Plan.

.bmp)