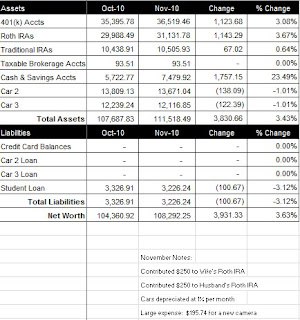

It’s hard to believe the end of 2010 is already here. We ended the year on a strong note, increasing our net worth $7,007.82 from last month, to a total of $115,300.07 (click on spreadsheet below).

What Worked

We passed our 2010 net worth goal of $105,700 last month, so December gave us an opportunity to make terrific headway on our 2011 net worth goal of $138,100. In December, we contributed $1,219.50 to our retirement accounts and saw them increase $5,437.42 to $83,594.59. We also increased our savings account balance by a $1,715.00 to a total of $9,215.82.

What Didn’t Work

We spent a ton of money this month, but I’ll get into that when I do our December income statement post in a couple of days.

Next Month

In the next few days, we’ll be reviewing our 2010 financial goals and posting our 2011 financial goals.