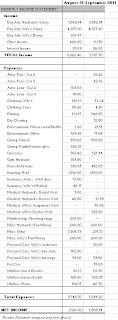

We continued our spending spree in March, albeit at a reduced rate. Our income was fairly typical (click on spreadsheet below).

Our total income for March was $7,484.97. In addition to our regular paychecks, my wife received $131.92 in reimbursements from her company (includes February internet & meal and March internet). We also received $75 in credit card rewards, a $35 rebate for purchasing an energy efficient washer, and earned $1.37 in interest income from our online savings account.

We did a little more shopping in March for our new home and spent a total of $9,560.07. Our spending over the past three months has been shocking: $22,902.72 in January, $14,038.03 in February, and $9,560.04 in March. At least the trend is going in the right direction. Some of the larger one-time expenses in March included $667.63 for ADT security installation, $400 for a security door, and $275 to our tax accountant.

Next month my check will be a smidge larger thanks to a 1% raise that my company provided all employees. This is a good sign as we have not had any raises for 4 years. The only large, non-reoccurring expense planned in April is $850 for a security camera system installation.