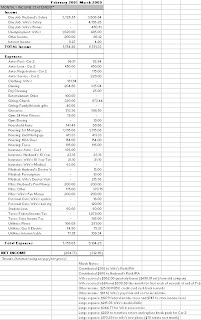

March was a strong income month (click on spreadsheet below), but a large month in terms of expenses.

In addition to my two paychecks, my wife received two paychecks for March and a paycheck for her first week of work at the end of February for a total of $4,196.26. She also received her final $405 unemployment from February and a $490.91 bonus check from her old company and $61.12 check from her old company for an insurance deduction mistake. All said and done, my wife brought in $5,153.29 for us this month. Oh, I earned a $25 HSBC cash back credit card reward (go me!). Our interest income on our savings account was $4.20.

Thank God we had a good income month because our expenses were insane ($9,104.29). Some of the larger expenses were: $2,024 total for federal and state income taxes, $229 to resurface my cars rotors and replace break pads, $215.36 for my wife’s medical bill, $344.77 for a Wii and accessories, $175 for my car registration, and $170.29 for a new phone for my wife (she will be receiving a $70 rebate next month). We were also apparently very hungry this month because we spent $506.50 on groceries and $335.04 eating out. We had our 3rd year anniversary, so $165 of dinning was for one REALLY nice dinner. I am going to increase our groceries budget from $400/month to $500/month, since this is what we have been averaging for the last 11 months. With

my wife’s new company car and company gas card, our fuel expenses were only $92.94.

Next month should be an average income month. In additional to our regular paychecks, we have ~$75 in credit card cash back rewards coming in, my wife will begin receiving her cell phone and internet reimbursements for a total of ~$110/month, and she should also get a $70 rebate from Verizon. In terms of non-monthly expenses, I have a $1,100 gym membership bill and we have a $50 Costco membership bill. I will be on a business trip for 7 days, so that may help reduce some of our expenses. To save some extra money, my wife will be canceling her $19/month gym membership and use our condo gym and Wii instead. She has also been cutting our dogs nails to save us a few extra bucks.