Below are our primary financial goals for 2010.

1) Increase net worth to $105,700

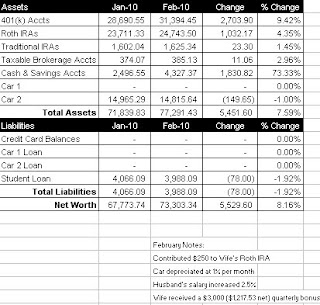

We finished 2009 with a net worth of $68,437.63, $7,162.37 short of our net worth goal. We’ve missed our net worth goal that past two years, so hopefully we can hit our 2010 goal of $105,700. We’re starting off a little behind the 8 ball because we didn’t hit our target this year, but based on my rudimentary forecast, this is a reasonable goal, and we should reach it if we stay focused.

2) Increase savings account balance to $20,000

We weren’t able to hit our savings goal in 2009 because we paid off our 6.5% auto loan instead. While we are starting 2010 with just a $2,492.73 balance in our savings account, I think we can reach $20,000 in savings if we make this a priority.

3) Contributing at least 15% of income to company 401(k)

This one is a gimme. My wife is already contributing 15% to her 401(k) and I’ve completed the paperwork to increase my 401(k) contribution from 8% to 15% in January. Now we just need to make sure we keep this up throughout the year.

4) Decrease debt by $1,000

After paying off our auto loan in 2009, the only debt we have left is $4,148.46 in student loans. We plan to pay $40/month extra to the student loan ($100/month total) so that we can reduce our debt by $1,000 in the next 12 months.

5) Increase tithe $25/month

We have been very blessed, especially since we began to be more faithful with our tithing, so we want in bump up our monthly tithe a bit. We consistently tithed $800/month in 2009 and plan to tithe $825/month in 2010.

It will be fun to look back in a year to see if we were successful in achieving these goals.