We just passed our net worth milestones of $1,950,000 to $2,010,000! Our net worth is currently $2,011,279. We passed our last net worth milestone of $1,940,000 way back in Nov 2021. We hope to reach our next milestone of $2,020,000 in a couple of months.

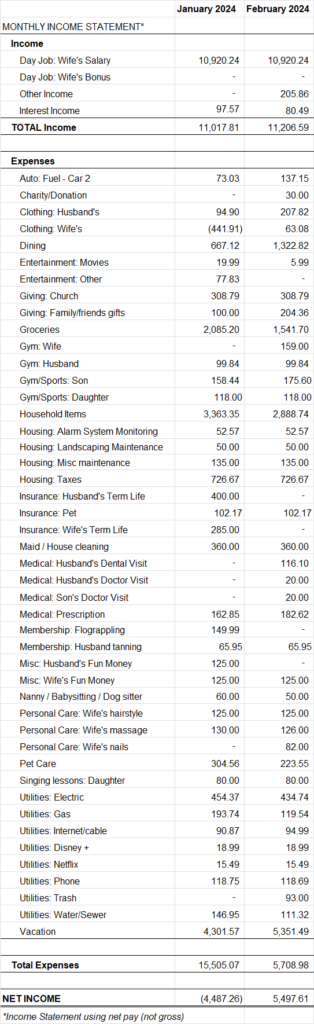

February 2024 Income Statement

In February, we had a regular income month and a highish expense month.

Our total income this month was $11,206.59. In addition to my wife’s regular paychecks, she received a $205.86 company reimbursement and we received $80.49 in interest income from our savings accounts.

This month, our expenses totaled $16,263.77. Large expenses included $5,351 for vacation, $1,322.82 for dining (mostly on vacation) and $270 for clothing.

Next month my wife will receive a $26,285 (gross) quarterly bonus and a 3.71% raise! So proud of her!

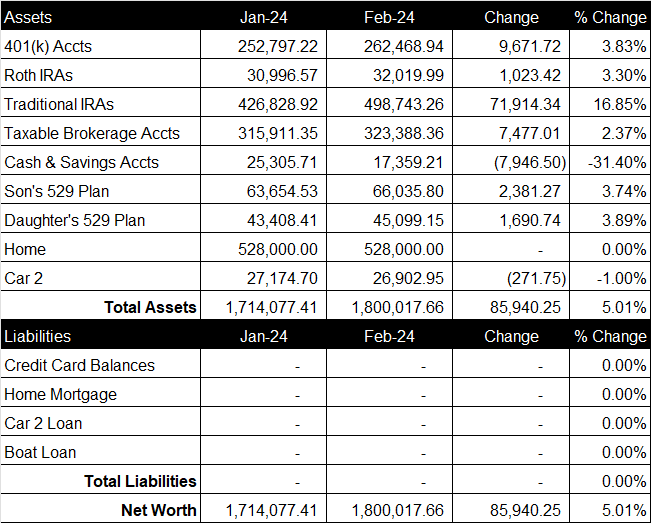

January 2024 Net Worth Update (+$85,940.25)

Overall

In February, our net worth increased $85,940.25 from last month to a total of $1,800,017.66 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contributed 7% to my wife’s 401(k) and her company matched 4% and chips in an additional 6% at the end of the year. This month, she contributed $1,150.52 to her 401(k). Since I do not work, I did not contribute anything to a retirement account. The total balance of our retirement accounts increased $82,609.48 from last month to a total of $793,232.19.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $323,388.36, up $7,477.01 from last month. We took a ~$70k loss on a cryptocurrency exchange bankruptcy but thankfully, the crypto market was up enough that our loss was offset.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings decreased $7,946.50 this month to a total of $17,359.21.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $2,381.27 from last month to a total balance of $63,654.53. We contributed $0 to our daughter’s 529 Plan and it increased $1,690.74 from last month to a total balance of $43,408.41. Our total 2024 contributions so far are $200 for our son and $200 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$895K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~95K miles) that we own and it is paid off.

Credit Card Balance

All of our credit card debt is paid in full each month.

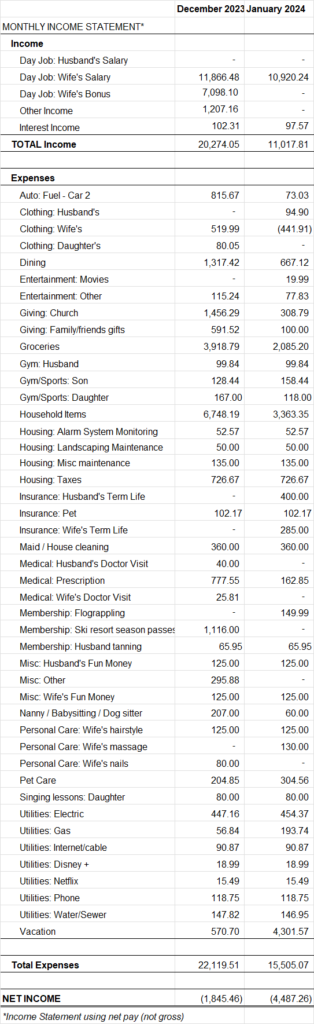

January 2024 Income Statement

In January, we had a regular income month and a highish expense month.

Our total income this month was $11,017.81. In addition to my wife’s regular paychecks, we received $97.57 in interest income from our savings accounts.

This month, our expenses totaled $15,505.07. Large expenses included $4,301.57 for vacation, $787.17 for insurance and $5,236 for food (groceries and dining).

Next month we have a big vacation planned so our expenses will likely be very high. Thank God my wife should receive a quarterly bonus in March.

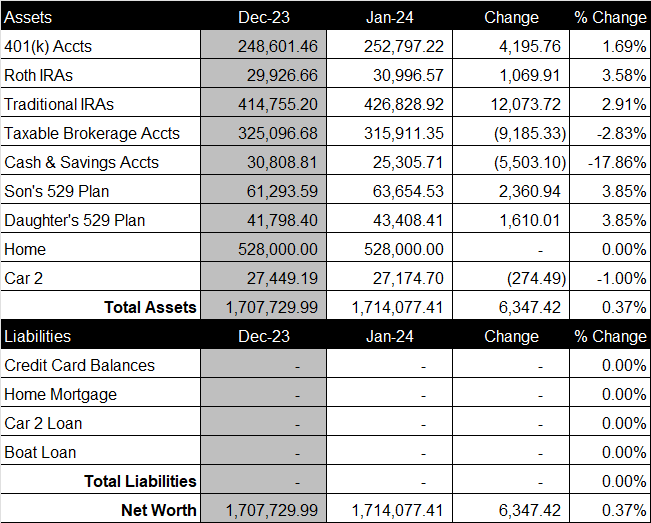

January 2024 Net Worth Update (+$6,347.42)

Overall

In January, our net worth increased $6,347.42 from last month to a total of $1,714,077.41 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contributed 7% to my wife’s 401(k) and her company matched 4% and chips in an additional 6% at the end of the year. This month, she contributed $1,150.52 to her 401(k). Since I do not work, I did not contribute anything to a retirement account. The total balance of our retirement accounts increased $8,154.06 from last month to a total of $710,622.71.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $315,911.35, down $9,185.33 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings decreased $5,503.10 this month to a total of $25,305.71.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $200 to our son’s 529 Plan and it increased $2,360.94 from last month to a total balance of $63,654.53. We contributed $200 to our daughter’s 529 Plan and it increased $1,610.01 from last month to a total balance of $43,408.41. Our total 2024 contributions so far are $200 for our son and $200 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$890K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~95K miles) that we own and it is paid off.

Credit Card Balance

All of our credit card debt is paid in full each month.

2024 FINANCIAL GOALS

Happy New Year! We hit all of our 2023 goals and plan to step up our goals for 2024. Below are our new financial goals for the coming year.

1) Pass our 2031 Net Worth Goal

We ended 2023 with a net worth of $1,707,729, 8 years ahead of our net worth goal schedule. We would like to maintain this lead and end 2024 with a net worth over $1,740K (our 2031 net worth goal). I’m not confident the stock market will help us reach this goal but our cryptocurrencies may over the coming year.

2) Give $5,000 to church

We hit our giving goal in 2023 and would like to increase to $5,000 in 2024.

3) Contribute $8,000 to 529 Plans ($4,000 for each child)

We are a little behind where we would like to be with our kids’ 529 Plans, so we will push harder in 2024 and aim to contribute $8,000 total to our kids’ 529 Plans ($4,000 for each child). Our son is currently 12 years old with a 529 Plan balance of $61,293 and our daughter is 9 years old with a 529 Plan balance of $41,798.

4) Maintain savings account balance of $30,000

We ended 2023 with $30,611 in savings, successfully hitting our goal for the year. We have two big vacations planned in 2024 that will deplete our saving substantially. On top of that, we need to pay our property taxes from our savings, further depleting it. That being said, we hope to add to our savings throughout the year so we can maintain a $30,000 balance by the end of 2024.

5) Book Mediterranean cruise

We feel very blessed to have exceeded our financial goals and want to begin focusing on creating more “memory dividends”. Money is a tool to have experiences and one experience we would like to have is a Mediterranean cruise in 2025. In order to make that happen, we will have to book (and pay for) the cruise this year.

REVIEW OF 2023 FINANCIAL GOALS

2023 was a great year financially. We were blessed to hit all five of our goals. Below are the details.

1) Pass our 2028 Net Worth Goal – SUCCESS

We started 2023 with a net worth of $1,243,252 and our goal was to end the year with a net worth of $1,320,000 (our 2028 net worth goal). We smashed this goal, ended 2023 with a net worth of $1,707,729. This puts us well past our 2030 net worth goal of $1,590,000.

2) Give $4,500 to church – SUCCESS

We started attending a new church in 2023 and are still feeling it out. So far, so good and thankfully, we were able to reach our goal of giving $4,500 in 2023. We gave a total of $8,494 in 2023.

3) Contribute $6,000 to 529 Plans ($3,000 for each child) – SUCCESS

This was the first goal that we hit in 2023. We contributed all $6,000 total to our kids’ 529 Plans ($3,000 for each child) by May 2023. We contributed $3,150 to our 12 years old son’s 529 Plan and his current balance is $61,293.59. We contributed $3,000 to our 9 years old daughter’s 529 Plan and her current balance is $41,798.4.

4) Building savings account balance to $15,000 – SUCCESS

We started 2023 with $10,353 in savings. Our goal was to build our savings to $15,000 by the end of 2023 and we were able to exceed that reaching a $30,611 in savings. This was possible due to success hitting goal #5, selling our boat.

5) Sell our boat – SUCCESS

We bought a ski boat six years ago for $70,000 out the door. It was a great way to enjoy quality time on the lake with the family but it was also a lot of work. We decided to take advantage of the unusually high boat market and list our boat for sale. We were able to sell it in May for $65,000, which was incredible and has funded family vacations and increased our savings.

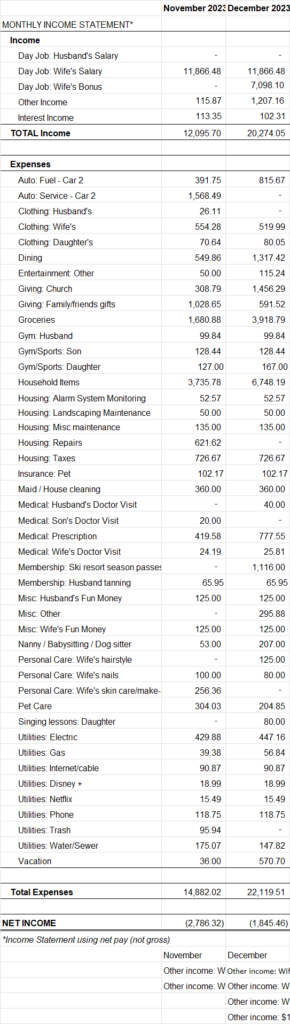

December 2023 Income Statement

In December, we had a great income month and a high expense month.

Our total income this month was $20,274.05. My wife maxed out on her 2023 social security contributions so her paychecks for the remainder of the year will be a bit larger ($5,993/paycheck vs $5,444.56/paycheck). In addition to my wife’s regular paychecks, she received a quarterly bonus of $11,475 gross ($7,098.10 net) and a $78.57 reimbursement for internet service. We also received an unexpected state tax refund of $1,128.59 and earned $102.31 in interest income from our savings accounts.

This month, our expenses totaled $22,119.51. Large expenses included $6,748 for household items, $2,047 in giving to church and friends/family, $5,236 for food (groceries and dining) and $1,116 in season passes for local ski resort.

Next month we start the new year and will post our 2024 goals soon.

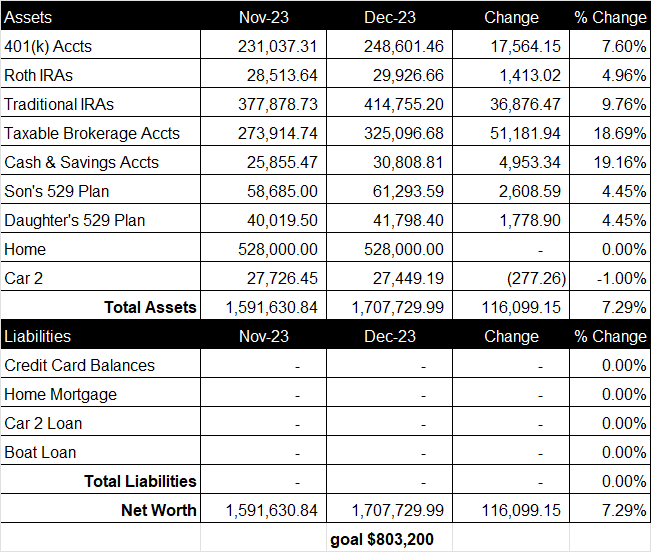

December 2023 Net Worth Update (+$116,099.15)

Overall

In December, our net worth increased $116,099.15 from last month to a total of $1,707,729.99 (see spreadsheet screenshot). What an amazing end to the year! In the coming days, I will be posting an update on how we did with your 2023 financial goals.

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contributed 7% to my wife’s 401(k) and her company matched 4% and chips in an additional 6% at the end of the year. This month, she contributed $1,724.27 to her 401(k). Since I do not work, I did not contribute anything to a retirement account. The total balance of our retirement accounts increased $55,853.64 from last month to a total of $693,283.32.

Brokerage Account

Currently, our brokerage accounts consist of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $325,096.68, up $51,181.94 from last month.

Cash & Savings Account

Cash and savings accounts consist of a small sum of cash at home, our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $4,953.34 this month to a total of $30,808.81.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $2,608.59 from last month to a total balance of $61,293.59. We contributed $0 to our daughter’s 529 Plan and it increased $1,778.90 from last month to a total balance of $41,798.40. Our total 2023 contributions were $3,150 for our son and $3,000 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$890K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~95K miles) that we own and it is paid off.

Credit Card Balance

All of our credit card debt is paid in full each month.

November 2023 Income Statement

In November, we had a regular income month and a high expense month.

Our total income this month was $12,095.70. My wife maxed out on her 2023 social security contributions so her paychecks for the remainder of the year will be a bit larger ($5,993/paycheck vs $5,444.56/paycheck). In addition to my wife’s regular paychecks, she received a $115.87 reimbursement for internet service. We also earned $113.35 in interest income from our savings accounts.

This month, our expenses totaled $14,882.02. Large expenses included $3,735.78 in household items, $1,568 in care service, and $624.92 on clothing.

Next month my wife should receive a quarter bonus of ~$10,000 gross.