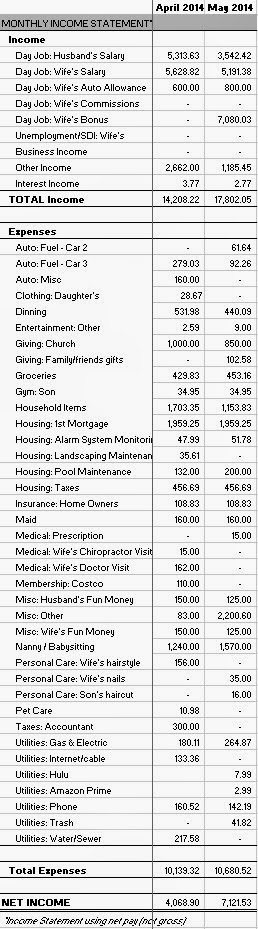

August was an awesome income month and we kept our expenses pretty well in line. (see attached spreadsheet).

Our total income in August was $18,070.88. In addition to my regular paychecks, my wife received $2,610.71 in disability, and a partial $3,006.96 paycheck after returning to work on the 18th. She also received a $13,050 gross ($8,009.69 net) quarterly bonus! My wife’s company paid her an $800 auto allowance and a $100 company reimbursement for internet service. We earned $4.50 in interest income from our online savings account.

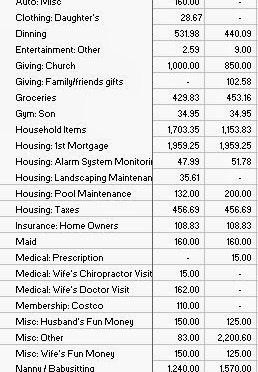

In August, we spent a total of $9,673.69. Some of the other larger, non-typical expenses include $200 new mobile phone for meand a larger than normal electricity bill of $525.25. In addition, our nanny’s weekly pay went from $300/week to $400/week as she began watching both of our children when my wife completed maternity leave. Our son also started preschool ($397/month).

September will be our last month with two incomes until I find a new job. I trust God has a great now position for me.