March 2017 Income Statement

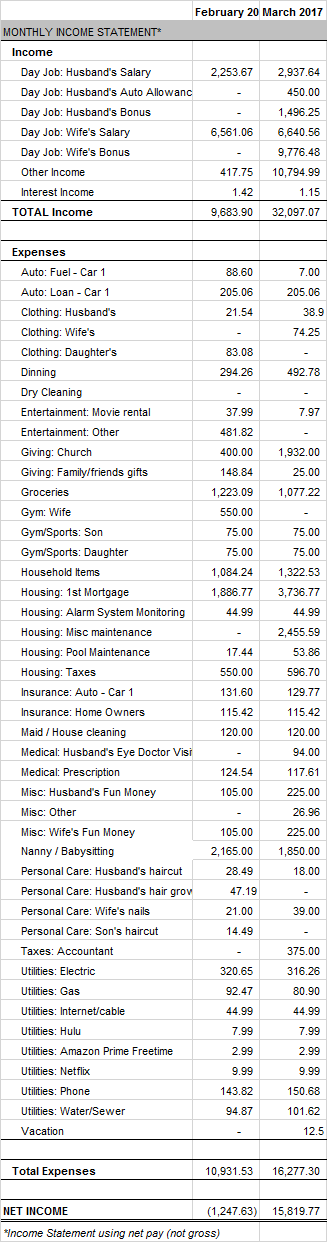

March was a phenomenal income month and a high expense month (see spreadsheet screenshot).

Our total income in March was $32,097.07, our second highest income month ever (April 2014 was our highest at $37,327). My wife received a 1.5% raise this month. In addition to our two regular paychecks, my wife received a quarterly bonus of $17,325 gross ($9,776.48 net) and I received a monthly bonus of $2,500 gross ($1,496.25 net). We also got a $10,750 tax refund ($8,688 federal, $2,062state), $450 in auto allowance from my company and $44.99 in internet reimbursement from my wife’s company. We earned $1.15 in interest income from our savings account.

This month, our expenses were high but they were surprisingly low relative to our income. We spent a total of $16,277.30 in March. Big ticket items include $2,000 in bathroom tilework, $1,950 in extra mortgage payments, and $375 to our tax account.

Next month forecasts should be a pretty typical expense and income month, with the exception of my $2,500 gross monthly bonus that will be a nice perk.

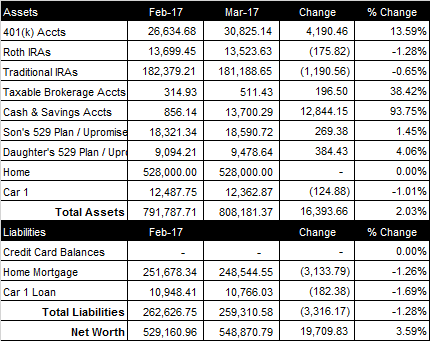

March 2017 Net Worth Update (+$19,709.83)

Overall

March was an AWESOME month. Our net worth increased $19,709.83 from last month to a total of $548,870.79 (see spreadsheet screenshot). We passed our $530K and $540K net worth milestones this month.

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited). I just started a new job and am not yet eligible for my company’s 401(k) plan. My wife contributed $1,373.75 to her 401(k) and her company deposited another $2,747.50 into her 401(k) for her 5% match and 5% extra “chip in”. The total balance of our retirement accounts increased $2,824.08 from last month to a total of $225,537.42.

Brokerage Account

Currently, our brokerage account consists of $500 cash and one stock (my wife’s old company) valued at $11.43 (on a $2,000.00 in initial investment). We are moving a little cash into our brokerage account as we are able to with the intent to make a purchase when the market dips again.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month our cash and savings accounts increased $12,844.15, bringing the total to $13,700.29.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $500 to our son’s 529 Plan and it increased $269.38 from last month to a total balance of $18,590.72. We also contributed $500 to our daughter’s 529 Plan and it increased $384.43 from last month to a total balance of $9,478.64.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $248,544.55. We paid $1,950 extra towards principal this month.

Cars

My wife has a company vehicle (and gas card) and I have a 2012 sedan with 65K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $10,766.03 at 1.99%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

NET WORTH MILESTONE: $540,000

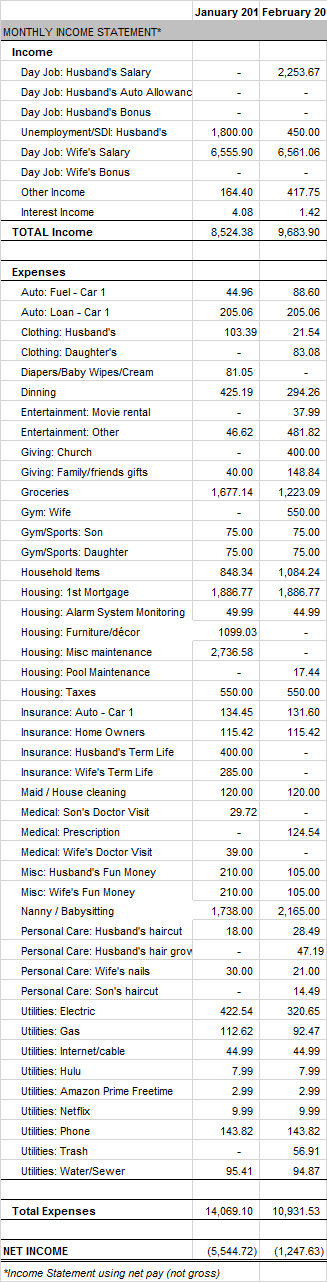

February 2017 Income Statement

February was a good income month and a lower than average expense month (see spreadsheet screenshot).

I started a new job on 1/30/75 and our total income in February was $9,683.90. My wife received her two regular paychecks and I received one week unemployment ($450), half a paycheck and a full paycheck. My wife also received $341.17 in company reimbursements. We also earned $1.42 in interest income from our savings account.

This month, our spending was lower than it has been in many months, although higher than our budget. We spent a total of $10,931.53 in February. Big ticket items include $2,165 in nanny/babysitting, $481.82 in concert tickets, and $550 for my wife’s gym membership (which her company reimbursed $320 of). We’ve did a much better job managing our grocery and dinning expenses.

Next month forecasts to be a HUGE income month. In addition to our regular paychecks, my wife should receive a $17K gross quarterly bonus, I will receive a $2,500 gross monthly bonus, and we may get a tax return. In addition, my wife will receive a 1.5% raise beginning her second check in March.

Net Worth Milestone: $530,000

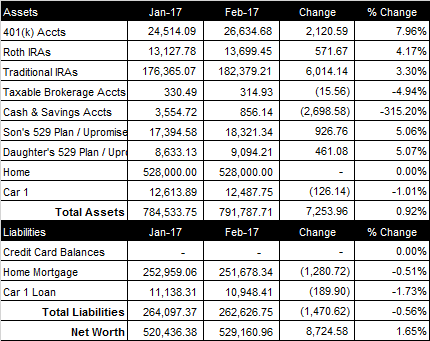

February 2017 Net Worth Update (+$8,724.58)

Overall

February was a very good month. Our net worth increased $8,724.58 from last month to a total of $529,160.96 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited). I just started a new job and am not yet eligible for my company’s 401(k) plan. My wife contributed $500 to her 401(k) and her company deposited another $1,000 into her 401(k) for her 5% match and 5% extra “chip in”. The total balance of our retirement accounts increased $8,706.40 from last month to a total of $222,713.34.

Brokerage Account

Currently, our brokerage account consists of $200 cash and one stock (my wife’s old company) valued at $14.93 (on a $2,000.00 in initial investment). This stock is going to zero L

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month our cash and savings accounts decreased $2,698.58, bringing the total to $856.14. Kind of scary, I know, but we will be refilling our savings next month with bonus money.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $926.76 from last month to a total balance of $18,321.34. We also contributed $0 to our daughter’s 529 Plan and it increased $461.08 from last month to a total balance of $9,094.21.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $251,678.34. We paid $100 extra towards principal this month.

Cars

My wife has a company vehicle (and gas card) and I have a 2012 sedan with 60K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $10,948.41 at 1.99%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

January 2017 Income Statement

NOTE: I am posting our January income statement early because I will be busy training at my new job next week:)

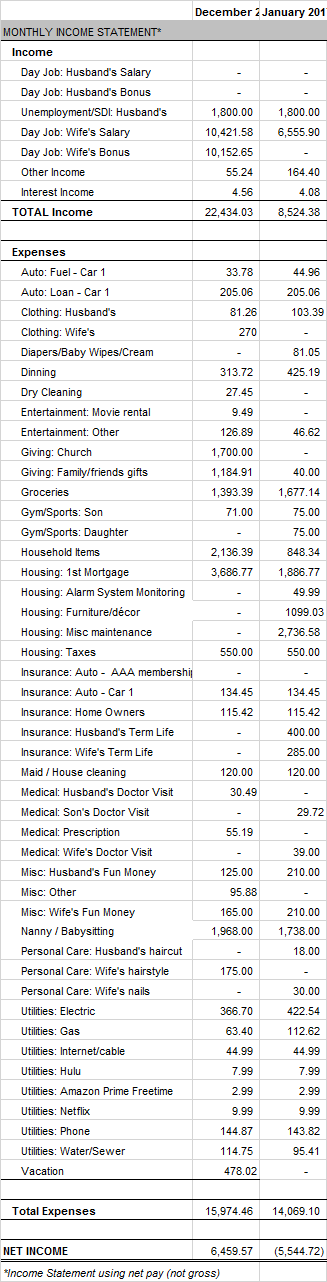

January was an average income month and a surprisingly large expense month (see spreadsheet screenshot).

Our total income in January was $8,524.38. My wife received her two regular paychecks and I received $1,800 in unemployment. My wife also received $44.99 in company reimbursements and we unexpectedly received a $93.16 Annual Escrow Acct Disclosure Statement refund. We also earned $4.08 in interest income from our savings account.

This month, our spending was higher than we would have liked, mostly due to a roof leak that resulted in a mold problem. We spent a total of $14,069.10 in January. Big ticket items include $2,736 in home repairs, $1,099 for a china cabinet, and $685 for our 20 year term life insurance (paid every six months).

Next month should be good. I start my new job on January 30th and February will be my first full month at my new job! In addition to my salary, I will receive a guaranteed bonus of $2,500/month for the first three months.

January 2017 Net Worth Update (+$3,005.74)

NOTE: I am posting our January net worth update early because I will be busy training at my new job next week🙂

Overall

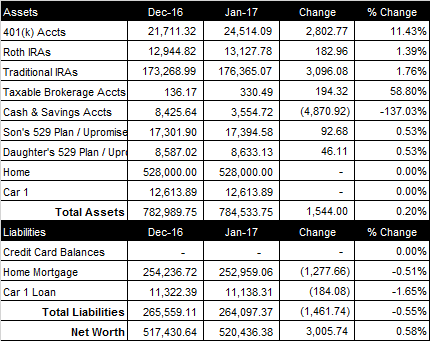

2017 got off to a pretty good start. We saw awesome gains in the market but the were offset a bit by pulling cash from savings. In January, our net worth increased $3,007.34 from last month to a total of $520,437.98 (see spreadsheet screenshot). It was great to pass our net worth milestone of $520K this month.

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited). My wife contributed $500 to her 401(k) and her company deposited another $1,000 into her 401(k) for her 5% match and 5% extra “chip in”. The total balance of our retirement accounts increased $6,081.81 from last month to a total of $214,006.94.

Brokerage Account

Currently, our brokerage account consists of $200 cash and one stock (my wife’s old company) valued at $27.84 (on a $2,000.00 in initial investment). YeahL

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month our cash and savings accounts decreased $4,870.92, bringing the total to $3,554.72. We pulled money out to pay for some water damage in our home and do a roof repair.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $92.68 from last month to a total balance of $17,394.58. We also contributed $0 to our daughter’s 529 Plan and it increased $46.11 from last month to a total balance of $8,633.13.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $252,959.06. We paid $100 extra towards principal this month.

Cars

My wife has a company vehicle (and gas card) and I have a 2012 sedan with 60K miles. The loan balance on my car is $11,138.31 at 1.99%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

2017 Financial Goals

Happy New Year! Financially, 2016 was a strong year for us, hitting four of our five 2016 financial goals. We’re looking forward to what the coming year brings and have listed our 2017 financial goals listed below. I’m excited to be starting off the new 2016 with a new job that begins January 30th (I was laid off in October).

1) Pass our 2020 Net Worth Goals

Going into 2017 with a net worth of 517,430.64, we’re blessed to be tracking ~3 years ahead of our net worth targets. We would love to pass our 2020 goal of $575,800 by the end of 2017 to keep our 3 year leed.

2) Start tithing again

We used to be consistent with our monthly giving. I can honestly say that the more we gave, the more we were blessed. After moving and trying to find a new church, we’ve lost the habit of give. We want to get back on track with our giving and intend to begin giving $200/month in 2016. It’s not a large amount but it is something that we should be able to consistently do and hopefully get back into the habit of giving.

3) Pay $5,000 extra towards mortgage principal

We purchased our new house in 2016 for $528K. We put $267K down and only had to get a $261K mortgage. Since the mortgage was small, we could afford a 15-year mortgage (at 2.875%). Our hope is that we can pay the mortgage off in 10 years. To do so, we plan to $100 in extra payments to principle each month and lump sum payments to principle whenever possible. We made $2,100 in extra payments to principle on our new home in 2016 (we moved in in July). Our current mortgage balance is $254,236.72 and we are shooting to do $5,000 in extra payments to principle in 2017.

4) Contribute $6,000 to 529 Plans ($3,000 for each child)

We’ve been able to consistently contribute $2,000/year to each of our kids 529 Plans. Our 5-year-old son’s 529 Plan has a balance of $17,301.90 and our 2-year-old daughter’s 529 Plan has a balance of $8,425.64. With the rising costs of tuition, we feel the need to pick up the pace of our contributions. We hope to be able to contribute $3,000 to each child’s 529 Plan in 2017.

5) Building savings account balance to $20,000

For the past few years, we’ve had the goal of reaching $20K in our savings. Unfortunately, this remains one of the goals that we can’t seem to reach. We ended 2016 with $8,425 in savings and hope to reach $20K in savings by the end of 2017.