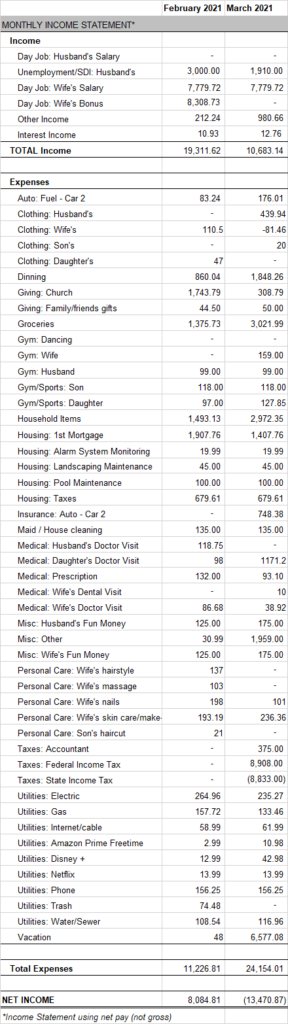

In March, we had an regular income month and a huge expense month.

Our total income in March was $10,683.14. In addition to my wife’s regular paychecks, I received $1,910 in unemployment (includes extra $300/week extra stimulus money). She received $0 in company reimbursements. We earned $12.76 in interest income from our savings accounts.

This month, our expenses totaled $24,154.01. Large, non-recurring expenses included $6,577 for vacation, $1,725 for half of estate plan, and $378 for clothing.

Next month, my wife will receive an “extra” third paycheck and I will receive an “extra” third unemployment check.