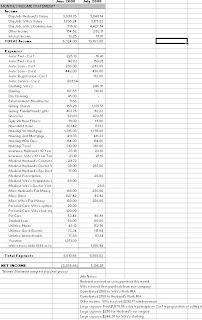

January was a surprisingly good income month (click on spreadsheet below) considering it was the first month of my wife’s laid off. We also had an equally good month for keeping our expenses low.

In addition to my two paychecks, my wife received a final $2,150.26 paycheck for 13 days of work and 3 days of vacation, a $60 reimbursement, $190 for babysitting, and her first unemployment check for $405 (with taxes deducted). We also received a $51.30 Citi credit card reward, $25 from selling a few items on craigslist.org, and earned interest income on our savings account of $16.71.

For the first time in a long time, our expenses came in well below budget; we only spent $5,379.39 in January. It’s great to see our belt tightening paid off. Every month we keep from touching our savings buys us more time.

Next month we have another new challenge. My company will be implementing a 20-25% reduction in pay beginning the 2nd half of the month. We also have ~$800 in medical bills for my wife that may come due. It will be more important than every for us to conserve cash.