March was a standard income month and a high expense month (see attached spreadsheet).

Category Archives: Income Statement

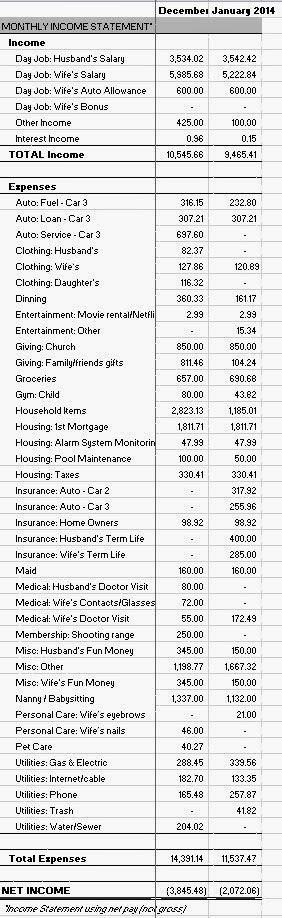

January 2014 Income Statement

January was a standard income month, and a large expense (see attached spreadsheet).

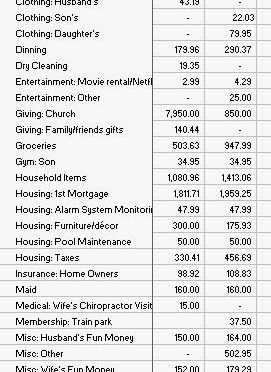

December 2013 Income Statement

December was a good income month, but also a large expense (see attached spreadsheet).

Our total income in December was $10,545.66. In addition to our regular paychecks, my wife received a $600 auto allowance, and a $100 company reimbursement for internet service. Our son also received a total of $275 cash for Christmas, which was deposited into his 529 Plan. We earned $0.96 in interest income from our online savings account.

In December, we spent a total of $14,391.14. Wow! That’s a lot of money. Some of the larger, non-typical expenses include $811.46 in gifts, $539.999 for a dishwasher, and $572.38 for a gun.

January should be a pretty standard income month and a hopefully a more reasonable expense month.

October 2013 Income Statement

October was an even better income month than last month, which was phenomenal, but it was also a large expense month(see attached spreadsheet).

September 2013 Income Statement

August 2013 Income Statement

August, in addition to being brutally hot, was an good income month and a huge expense month too (see attached spreadsheet).

September will be interesting. It will be my wife’s first full month at her new company. Plus, she still is due 1 final week of pay from her old company.

July 2013 Income Statement

July was an average income month and a larger than budget expense month (see attached spreadsheet).

Our total income in July was $8,083.39. In addition to our regular paychecks, my wife received a $25 company reimbursement. We also received $45.36 in credit card cash back rewards and earned $2.71 in interest income from our online savings account.

August will be interesting. My wife will be giving her 2 week notice and does not start her new job until the end of August. Hopefully her current company won’t let her go as soon as she gives notice.

June 2013 Income Statement

May 2013 Income Statement

May was a nice large income month and a large expense month too (see attached spreadsheet).

April 2013 Income Statement

April saw a boost in our income, thanks to my wife beginning her new job mid-month. Sadly, our expenses were extraordinarily high (see attached spreadsheet).