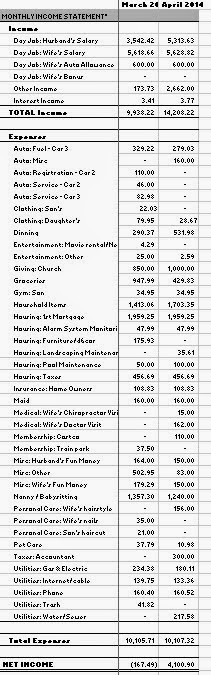

January was an okay income month and another larger than budgeted expense month (see spreadsheet screenshot).

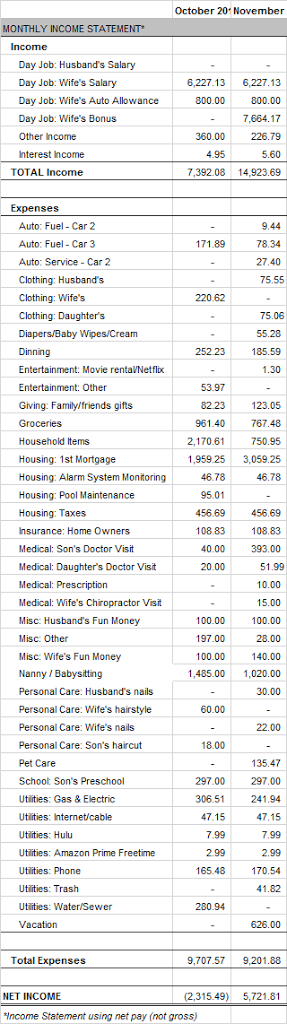

Our total income in December was $7,183.63. In addition to my wife’s paychecks, she received an $800 auto allowance and a $100 company reimbursement for internet service. We received $250 in preschool reimbursement, $90 selling items on Craigslist, and earned $4.89 in interest income from our online savings account.

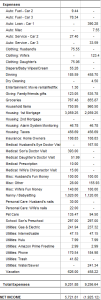

In January, we spent a total of $9,746.39. Some of our larger non-standard expenses were $685 for 6 months term life insurance (wife and I), $635 for 6 months auto insurance (2 cars), $485.11 for clothing, and $156.1for vacation. We let our nanny go mid-month, so there was reduced spending in that area.

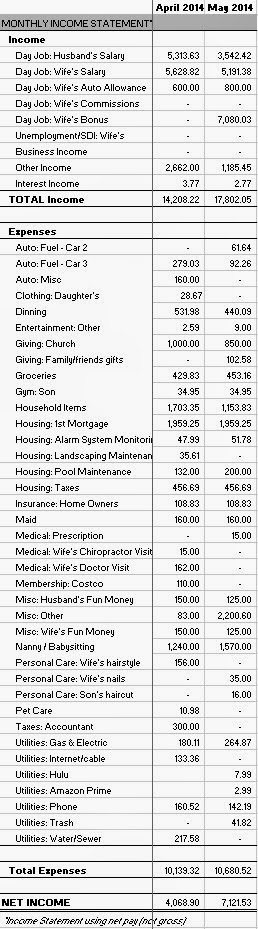

Next month should be a good income month with my wife receiving her 34% raise and a quarterly bonus of approximately $15K.