We just passed our net worth milestones of $2,100,000 to $2,140,000! Our net worth is currently $2,142,586.65. We passed our last net worth milestone of $2,090,000 last month. We hope to reach our next milestone of $2,150,000 in a few weeks.

Category Archives: Goals

NET WORTH MILESTONES: $1,950K – $2,010K

We just passed our net worth milestones of $1,950,000 to $2,010,000! Our net worth is currently $2,011,279. We passed our last net worth milestone of $1,940,000 way back in Nov 2021. We hope to reach our next milestone of $2,020,000 in a couple of months.

2024 FINANCIAL GOALS

Happy New Year! We hit all of our 2023 goals and plan to step up our goals for 2024. Below are our new financial goals for the coming year.

1) Pass our 2031 Net Worth Goal

We ended 2023 with a net worth of $1,707,729, 8 years ahead of our net worth goal schedule. We would like to maintain this lead and end 2024 with a net worth over $1,740K (our 2031 net worth goal). I’m not confident the stock market will help us reach this goal but our cryptocurrencies may over the coming year.

2) Give $5,000 to church

We hit our giving goal in 2023 and would like to increase to $5,000 in 2024.

3) Contribute $8,000 to 529 Plans ($4,000 for each child)

We are a little behind where we would like to be with our kids’ 529 Plans, so we will push harder in 2024 and aim to contribute $8,000 total to our kids’ 529 Plans ($4,000 for each child). Our son is currently 12 years old with a 529 Plan balance of $61,293 and our daughter is 9 years old with a 529 Plan balance of $41,798.

4) Maintain savings account balance of $30,000

We ended 2023 with $30,611 in savings, successfully hitting our goal for the year. We have two big vacations planned in 2024 that will deplete our saving substantially. On top of that, we need to pay our property taxes from our savings, further depleting it. That being said, we hope to add to our savings throughout the year so we can maintain a $30,000 balance by the end of 2024.

5) Book Mediterranean cruise

We feel very blessed to have exceeded our financial goals and want to begin focusing on creating more “memory dividends”. Money is a tool to have experiences and one experience we would like to have is a Mediterranean cruise in 2025. In order to make that happen, we will have to book (and pay for) the cruise this year.

REVIEW OF 2023 FINANCIAL GOALS

2023 was a great year financially. We were blessed to hit all five of our goals. Below are the details.

1) Pass our 2028 Net Worth Goal – SUCCESS

We started 2023 with a net worth of $1,243,252 and our goal was to end the year with a net worth of $1,320,000 (our 2028 net worth goal). We smashed this goal, ended 2023 with a net worth of $1,707,729. This puts us well past our 2030 net worth goal of $1,590,000.

2) Give $4,500 to church – SUCCESS

We started attending a new church in 2023 and are still feeling it out. So far, so good and thankfully, we were able to reach our goal of giving $4,500 in 2023. We gave a total of $8,494 in 2023.

3) Contribute $6,000 to 529 Plans ($3,000 for each child) – SUCCESS

This was the first goal that we hit in 2023. We contributed all $6,000 total to our kids’ 529 Plans ($3,000 for each child) by May 2023. We contributed $3,150 to our 12 years old son’s 529 Plan and his current balance is $61,293.59. We contributed $3,000 to our 9 years old daughter’s 529 Plan and her current balance is $41,798.4.

4) Building savings account balance to $15,000 – SUCCESS

We started 2023 with $10,353 in savings. Our goal was to build our savings to $15,000 by the end of 2023 and we were able to exceed that reaching a $30,611 in savings. This was possible due to success hitting goal #5, selling our boat.

5) Sell our boat – SUCCESS

We bought a ski boat six years ago for $70,000 out the door. It was a great way to enjoy quality time on the lake with the family but it was also a lot of work. We decided to take advantage of the unusually high boat market and list our boat for sale. We were able to sell it in May for $65,000, which was incredible and has funded family vacations and increased our savings.

REVIEW OF 2021 FINANCIAL GOALS

Happy New Year! Financially, 2021 was an amazing year, reaching almost all of our 2021 financial goals. In fact, we exceeded most of our goals by a large margin. This is quite an achievement considering that I quit my job in October 2020. Thank God it all worked out lol. Thankfully, my wife has an amazing job that she is stellar at. Below are the results of our 2021 financial goals:

1) Pass our 2028 Net Worth Goal – SUCCESS

We started 2021 with a net worth of $1,252,846 (7 years ahead of schedule) and hoped to pass our 2028 net worth goal of $1,320,000 by the end of the year. We obliterated this goal reaching a net worth of $1,759,061 by the end of 2021. We were blessed to surpass our 2028 goal ($1,320K), 2029 goal ($1,450K), 2030 goal ($1,590K) and 2031 goal ($1,740K)! We are now 10 years ahead of schedule for the net worth goals that we set for ourselves in 2007.

2) Give to church – SUCCESS

We set a goal of giving $3,600 to our church in 2021 and end up giving $6,748. It feels great to have exceeded this goal!

3) Pay home mortgage down to under $200K – SUCCESS

We started 2021 with a $213K mortgage balance and were able to completely pay off our mortgage in August 2021 taking profits from some of our cryptocurrencies. Another goal completely smashed!

4) Contribute $4,000 to 529 Plans ($2,00 for each child) – SUCCESS

We ended 2020 with $37,958.69 in our son’s 529 Plan and $23,361.36 in our daughter’s 529 Plan. We planned to contribute $1,500 to each of their 529 Plans in 2021 and actually contributed $3,950 to our son’s and $3,990 to our daughters. We almost doubled our planned contributions! They now have $53,343.31 and $34,671.16 in their 529 Plans, respectfully.

5) Building savings account balance to $30,000 – FAIL

We started 2021 with $30,361.39 in savings and hoped to keep at least $30K in savings after paying property tax. Due to a poorly timed investment (funded with some of our savings), we ended 2021 with $27,083 in savings.

NET WORTH MILESTONE: $1,940K

We just passed our net worth milestone of $1,940,000! Our net worth is currently $1,943,172. We passed our last net worth milestone of $1,930,000 two days ago. We hope to reach our next milestone of $1,950,000 later this month.

NET WORTH MILESTONES: $1,910K – $1,930K

We just passed our net worth milestones of $1,910,000 to $1,930,000! Our net worth is currently $1,933,908. We passed our last net worth milestone of $1,900,000 last month. We hope to reach our next milestone of $1,940,000 later this month.

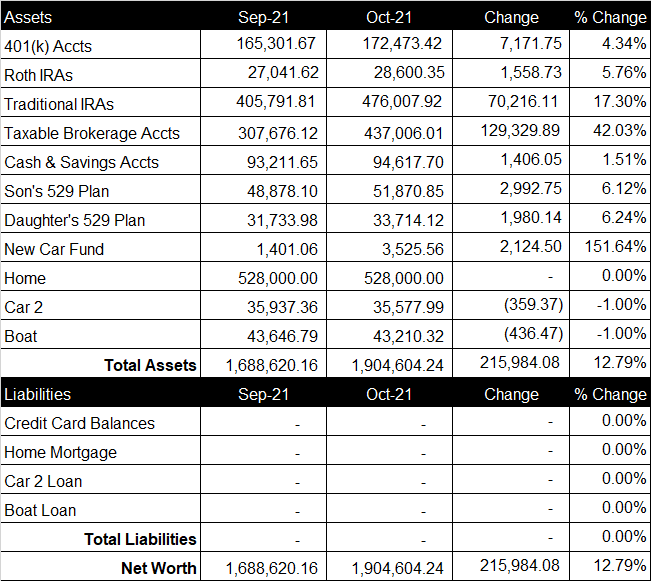

October 2021 Net Worth Update (+215,984.08)

Overall

October was an incredible month for our net worth. Our net worth increased $215,984.08 from last month to a total of $1,904,604.24 (see spreadsheet screenshot). We passed our net worth milestones of $1,800K to $1,900K this month!

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 6% of her 401(K) contribution and chips in an additional 3% on top of the match at the end of the year (vests over 5 years). This month, we contributed $1,366.65 to her 401(k). Since I am unemployed, I did not contribute anything to my retirement accounts. The total balance of our retirement accounts increased $78,946.59 from last month to a total of $677,081.69 .

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value of our brokerage accounts is $437,006.01, up $129,329.89 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home, our online savings accounts balance and stablecoins that we earn interest on. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $1,406.05 this month to a total of $94,617.70.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $100 to our son’s 529 Plan and it increased $2,992.75 from last month to a total balance of $51,870.85. We contributed $100 to our daughter’s 529 Plan and it increased $1,980.14 from last month to a total balance of $33,714.12. Total 2021 contributions thus far are $3,950 for our son and $3,990 for our daughter.

Home

For our home value, we use the $528K purchase price that we paid in July 2016. Current comps in the area are ~$840K. We paid off our home in September 2021.

Vehicles

My wife drives a company vehicle and has a company gas card. I drive a 2017 SUV (~85K miles) that we own. In addition, we own a 2013 ski boat.

New Vehicle Fund

Our new car fund is intended to cover future vehicles for our family. Contributions are invested in cryptocurrencies. We track these crypto investments separately for our others (see brokerage account above). This month, our new car fund increased $2,124.50 from last month to a total of $3,525.56.

Credit Card Balance

All of our credit card debt is paid in full each month.

NET WORTH MILESTONES: $1,880K – $1,900K

We just passed our net worth milestones of $1,880,000 to $1,900,000! Our net worth is currently $1,901,706. We passed our last net worth milestone of $1,870,000 yesterday. We hope to reach our next milestone of $1,910,000 by November.

NET WORTH MILESTONES: $1,860K – $1,870K

We just passed our net worth milestones of $1,860,000 to $1,870,000! Our net worth is currently $1,871,752. We passed our last net worth milestone of $1,850,000 a few days ago. We hope to reach our next milestone of $1,880,000 by November.