The Carnival of Personal Finance was hosted by the The Writer’s Coin this month and I’m happy to say that my post We Don’t Bank With Them, But We Bought Their Stock made the cut. Please check it out. Thanks Writer’s Coin!

All posts by 1MansMoney

Didn’t We Just Sell A Truck?

One of the drawbacks of my wife getting laid off is that she no longer has a company car. Initially, we thought we could get away with one vehicle until my wife finds another job. It’s turning out that that is not the case, and there’s no guarantee that when she finds a job it will include a company car. So, we decided that we’re going to buy a cheap used truck. You might be thinking the same thing as me, didn’t we just sell a truck?

We can get a small truck with just under 100K miles for ~$3,000-$4,000. At that price, we can pay cash for it and avoid car payments. We decided on a truck rather than a car because we wanted something a bit more functional. If my wife gets another job with a company car, our plan would be to keep the truck as a back-up vehicle in case, A) We’re put into the same position again down the road. B) Our main vehicle has to go in the shop for some reason. C) We have to move anything/carry a large load.

I hate to see our savings drop $3K-$4K, but am glad we have the cash to make this happen. We’ll probably start looking at trucks next week.

We Don’t Bank With Them, But We Bought Their Stock

We sold our Toyota Motor Corporation stock (symbol: TM) for a small gain in mid December because we wanted to increase our savings once we got word my wife was to be laid off January 1st. Well this money didn’t stay in our savings account long because we purchased 106 shares Bank of America Corporation stock (symbol: BAC) today of for $14/share.

We’ve been wanting to take advantage of the depressed stock market as much as we’re able to and the financial sector is about as depressed as it gets. We chose to purchase Bank of America stock because we felt it offered the best combination of risk and reward.

Bank of America purchased Merrill Lynch this month, making them the largest financial services company in the world. It seems like they have positioned themselves nicely during this bad economy to come back strong when it rebounds.

For the 4 years prior to 2008, Bank of America stock has been over $40/share, and at times, over $50/share. Taking a look at Bank of America stock price over the last 52-weeks, their high was $45.08/share and their low was $10.01/share. That being said, we believe there is very good upside potential. . .time will tell.

What’s interesting is that we do not bank with Bank of America because they got a little fee crazy and I had to close my account a couple of years ago. The flip side is that all of those fees make for a profitable business. Let’s hope we can share in that profit.

God Takes Good Care of Us

My wife has always counted on God to help her when she needs to find a new job and it’s amazing to watch Him make things work out. Here are just a few examples from the past week:

She was informed on Wednesday that the company she interviewed with last month had decided to hire her, but unfortunately, the company was purchased and the new Owners will not be bringing any new employees onboard. It was sad that she was so close, but good to know that her interviewing skills are still sharp. Plus, this company may decide to hire her at some point down the road.

While we had hoped that she could seamlessly transition to a new job, it wasn’t in the cards. However, she received her final check from her company yesterday and it was much, much more than we thought it would be. She expected to receive 3 days pay for the end of December and 3 days of pay for her cashed in vacation time. Well, the check was for 13 days of pay for the end of December and 3 days of pay for her vacation time. After taxes and a $121 contribution to her 401(k), the check came to $2,150.26! This as a huge blessing and will buy us even more time while my wife looks for a new job.

My wife also received a call from a friend who offered her $360 if she would help her with her work one day this month. That’s good money for one day’s worth of work. My wife offered to help this friend last year when she was in a pinch, and although she did not accept the offer, she did remembered it and is now returning the favor.

My wife filed for unemployment last week and received a call from them yesterday. The lady told her that if she waited just one week, it would put her in a higher income quarter from which they calculate her benefits. This small suggestion had a big impact on her benefits, as they increased from $375/week to $450/week. Granted, she will miss out on one unemployment check because of the delay, but it will only take a few weeks to make up the missed check.

And finally, my wife has begun watching our neighbor’s child will probably earn $120 or more this month for just a few hours of work. Our neighbor’s child is a very good kid and my wife can take care of her and search online for jobs at the same time.

We’re confident that God will provide my wife with a great new job, but in the meantime, He’s taking pretty good care of us.

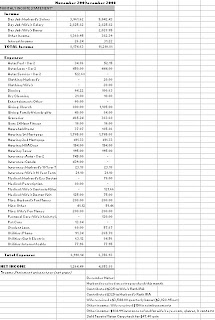

December 2008 Income Statement

December was a big income month for us. In fact, it was our 2nd largest yet at $11,210.81 (click on spreadsheet below).

In addition to our regular paychecks, I received a third “extra” paycheck and my wife received a huge $3,544.00 quarterly bonus ($2,028.95 net). We also received a $184.99 eye insurance refund, $150 reimbursement from my wife’s company, and we sold our 15 shares of Toyota Motor Corp stock for $47.40 gain. We also earned $31.22 in interest income on our savings account.

Even with the holidays, we were able to keep our expenses very much in line. Our cell phone bill was higher than usual and my wife had a few doctor visits, but no real large expenses. In fact, if you subtract out the extra $305 we tithed from my wife’s bonus check, we were right on par with our budget.

Next month, my wife will be unemployed, so our income will drop significantly. We have planned to dramatically reduce our expenses to ensure we don’t have to tap into our savings for a few months.

2009 Goals

Since we are on the eve of the new year, I thought it would be appropriate to post our goals for 2009. I’m not sure what to expect in 2009, but we have great hopes. Below are a few of our goals for 2009.

1) Increase net worth to $75,600

This should be doable if we are able to hit most of the goals below.

2) Wife to get a new job

Ideally, my wife will get a job in the same industry as her last job and receive similar benefits, such as a company car and matching 401(k). How long the job search takes will determine whether or not we are able to hit our other goals.

3) Increase savings account balance to $20,000

Our saving account balance is currently just over $15,000, but this goal will be harder than it looks. Some of our current savings is earmarked for property taxes, income taxes, and a vacation to Hawaii in 2009.

4) Max out Roth IRAs ($5,000 each)

We missed this goal in 2008, but I hope we can bounce back in 2009.

5) Contributing at least 5% of income to company 401(k)

This is already set on autopilot, so I don’t see a problem reaching this goal.

6) Decrease debt by $8,000

This should be an easy goal, if we are able continue paying down our debt at the same rate as last year.

7) Draft wills

We’ve been putting this off for awhile, but will make it a priority in 2009.

So, we’ve got some pretty challenging goals for 2009. God willing, the economy will start to turn around and help us all reach our goals. Have a safe and Happy New Year!

2008 Net Worth Recap

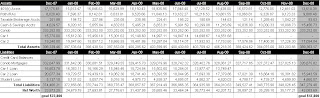

2008 was a great year, even with the very rough economy. Below is a table compiling our net worth data for 2008 (click on table to enlarge). Some highlights from 2008 include:

- We increased our net worth from $23,873.25 to $ 42,083.69. We missed our net worth goal of $47,800.00 by $5,716.31, but still made good progress.

- We increased our savings account balance from $4,629.57 to $15,651.73. This cash will help provide us some security while my wife looks for a new job.

- We contributed $6,250.00 total to our Roth IRAs. We had hoped to max out our Roth IRA contributions ($5,000 each), but boosting our savings became a priority instead.

- We contributed $4,797.69 total to our 401(k) plans. No real target here, just wanted to continue adding to it.

- We reduced our debt from $374,466.21 to $347,279.48. Over 1/2 of this reduction was from selling Car 1.

We have great hopes for 2009. I will be posting our 2009 goals very soon.

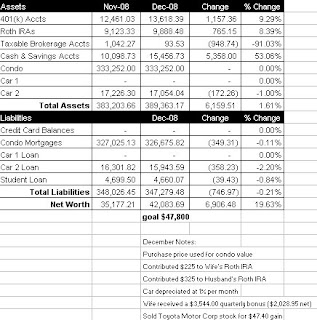

December 2008 Net Worth Update (+6,906.48)

Since we will be traveling for the holidays, I am posting our December net worth a bit early.

Our net worth in December increased $6,906.48 over last month to $42,083.69 (click on spreadsheet below). This is one of our strongest monthly increases yet and is a nice change from the decrease in our net worth over the last 3 months. Unfortunately, even with this very strong month, we came up $5,716.31 short of our 2008 net worth goal of $47,800. All things considered, with this economy, that’s not too bad. We reached 88.04% of our goal for the year.

What worked

We contributed a total of $1,198.50 to our 401(k)s and Roth IRAs. We also deposited a whopping $4,357.40 into our savings account, thanks mainly to my wife’s $3,544.00 quarterly bonus ($2,028.95 net).

What did not work

Nothing I could find. December was a good month.

Next month

My wife received notice that December 31st will be her last day of employment. Therefore, we don’t expect to be able to increase our net worth much, if any, in January. She has already had a successful day of interviewing with another company and has been networking to find a new job. With my paychecks, her unemployment checks, and a bit of baby sitting money, we shouldn’t have to pull any money out of savings for quite a few months.

The Carnival of Personal Finance #184: From the Land Down Under

Andy at Saving To Invest just did a great job hosting the The Carnival of Personal Finance #184: From the Land Down Under. As the title hints, this carnival had a fun “Aussie” theme. Check it out when you have a chance. My post The Unemployment Rate Just Went Up A Tad was included in the carnival. Thanks Andy!

Bonus Check Arrived

Just a quick note to let everyone know that my wife just received her $3,544.00 quarterly bonus. Bonuses are heavily taxed, so it ended up being $2,028.95 net. We’re tithing some of it and putting the rest in the bank for a nice boost to our savings account. Even though her last day with the company is December 31st, she will still receive another quarterly bonus in March for the work she has done up to this point.