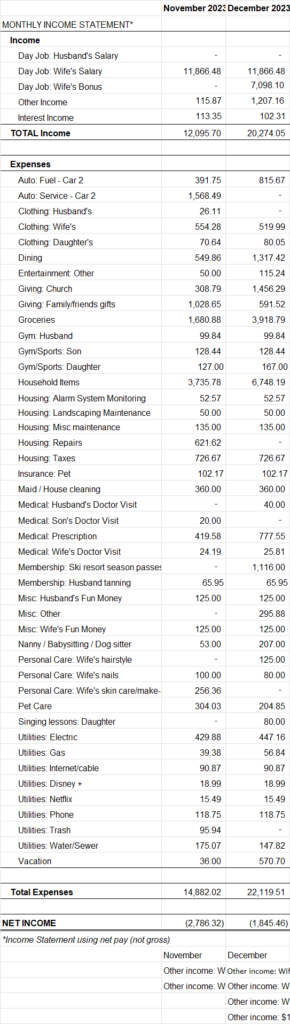

Happy New Year! We hit all of our 2023 goals and plan to step up our goals for 2024. Below are our new financial goals for the coming year.

1) Pass our 2031 Net Worth Goal

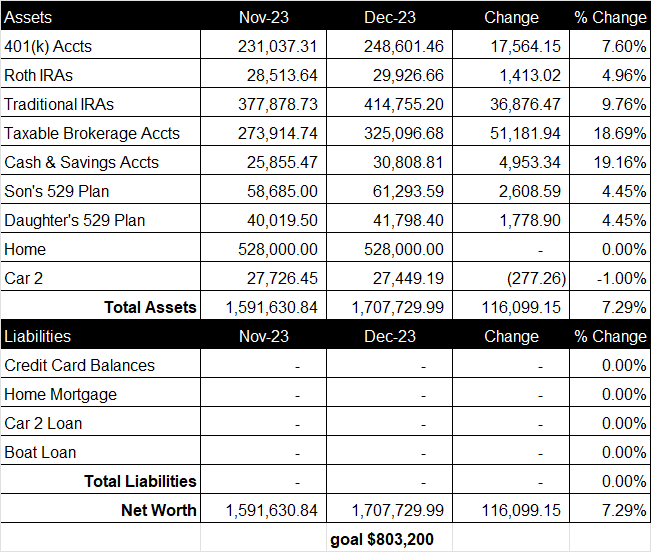

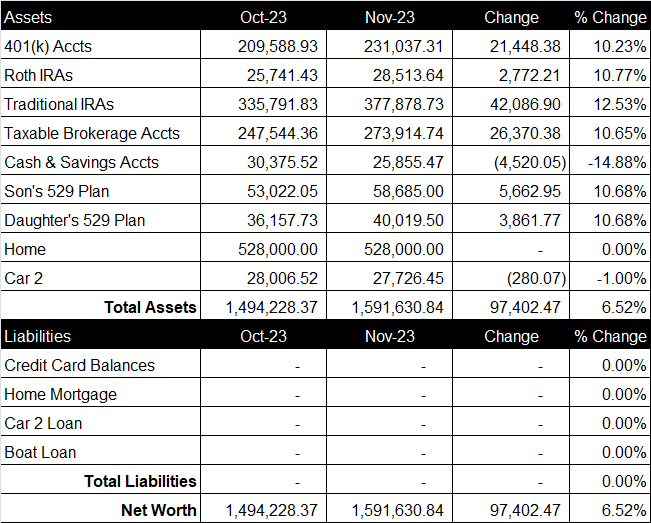

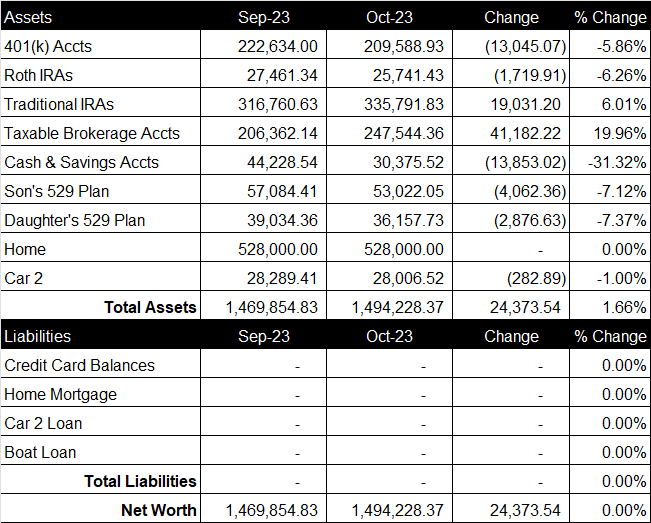

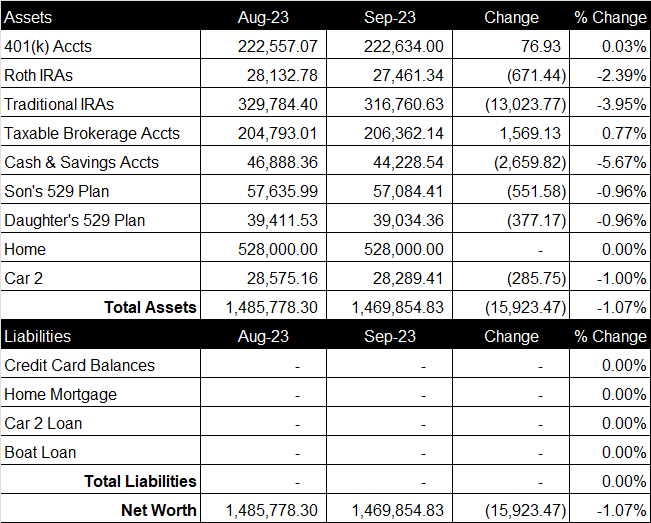

We ended 2023 with a net worth of $1,707,729, 8 years ahead of our net worth goal schedule. We would like to maintain this lead and end 2024 with a net worth over $1,740K (our 2031 net worth goal). I’m not confident the stock market will help us reach this goal but our cryptocurrencies may over the coming year.

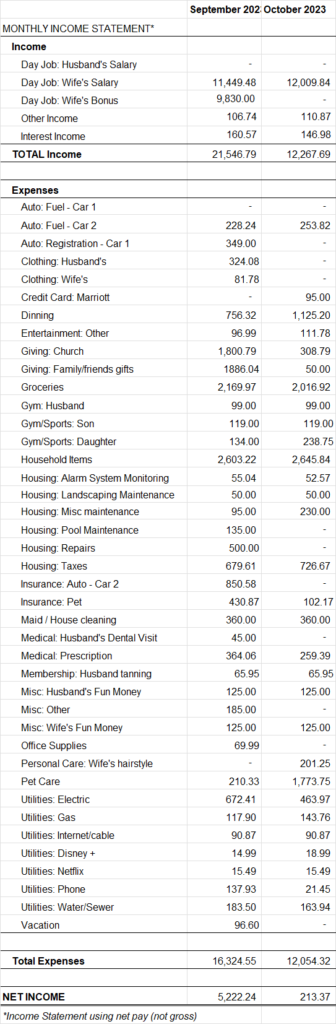

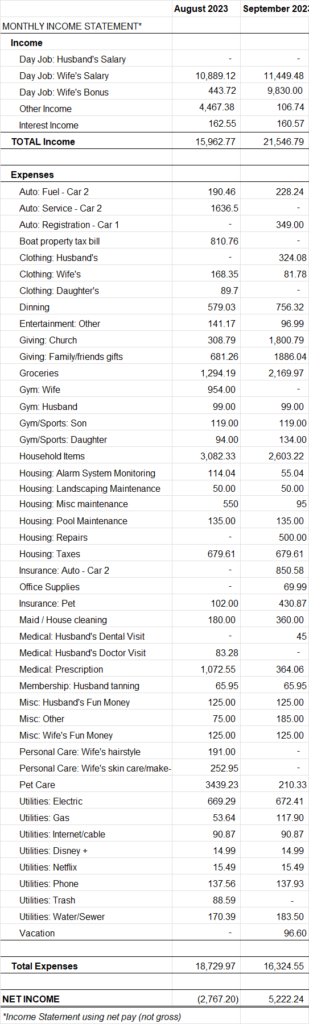

2) Give $5,000 to church

We hit our giving goal in 2023 and would like to increase to $5,000 in 2024.

3) Contribute $8,000 to 529 Plans ($4,000 for each child)

We are a little behind where we would like to be with our kids’ 529 Plans, so we will push harder in 2024 and aim to contribute $8,000 total to our kids’ 529 Plans ($4,000 for each child). Our son is currently 12 years old with a 529 Plan balance of $61,293 and our daughter is 9 years old with a 529 Plan balance of $41,798.

4) Maintain savings account balance of $30,000

We ended 2023 with $30,611 in savings, successfully hitting our goal for the year. We have two big vacations planned in 2024 that will deplete our saving substantially. On top of that, we need to pay our property taxes from our savings, further depleting it. That being said, we hope to add to our savings throughout the year so we can maintain a $30,000 balance by the end of 2024.

5) Book Mediterranean cruise

We feel very blessed to have exceeded our financial goals and want to begin focusing on creating more “memory dividends”. Money is a tool to have experiences and one experience we would like to have is a Mediterranean cruise in 2025. In order to make that happen, we will have to book (and pay for) the cruise this year.