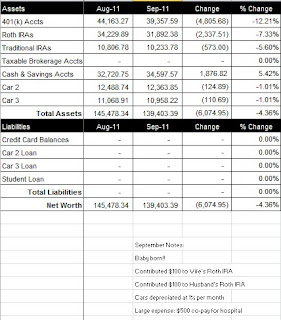

It’s a BOY!!! Our son was born at the end of September, making this our best month EVER. Being new parents is a lot of work, but there is nothing that comes close to the amazing feeling. We the excitement of our new baby, I haven’t had a second thought about our net worth getting pummeled again this month. Our net worth decreased $6,074.95 from last month, to a total of $139,403.39 (click on spreadsheet below).

What Worked

Our beautiful baby boy was born!

What Didn’t Work

We contributed $1,013.00 to our retirement accounts, but saw them decrease $7,716.19 to $81,483.75.

Next Month

Going forward, my wife’s net income will be reduced because of her new 401(k) contribution and we will be adding our baby to her insurance. We have elected to begin contributing 10% of my wife’s pay to her 401(k) plan during her first open enrollment in October (the company matches 6% with a 3 year vesting period). We will also be adding the baby to my wife’s insurance, increasing the cost from $75/month to $325/month.