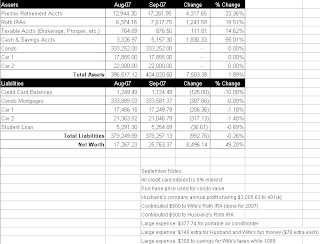

August has been a volatile month in more ways than one. Nonetheless, our net worth increased $2,205.39 over last month, to $17,267.23 (click on spreadsheet below). We are currently at 78.49% of our 2007 net worth goal. Thank God, we’re still ahead of schedule to meet our goal.

What worked this month?

I received an extra (3rd) check this month that provided us with an additional $1,880.70. We were able to increase our savings by $831.02, which is amazing because we had a couple of large expenses come due in August, such as a $716.53 mattress bill and $300 seat sponsorship for our church. Surprisingly, we did not have a $1,000 business expense that we are expecting post to our credit card; this will likely post in September. In other good news, we were also able to contribute another $500 to my wife’s Roth IRA and we continue to make progress on our liabilities, decreasing them by ~$1,000 each month.

What did not work this month?

Obviously, this was a roller coaster month for the stock market. After subtracting out our contributions, our retirement investments were either flat or lagged behind last month’s balances. Another shake-up this month was that the company my wife just started with 1 month ago laid off 75% of their employees, including her. The great news is that she already has a replacement job.

What’s coming next month?

Now that August’s books are closed, we’re looking ahead toward September. All indications are that it should be a good month too. My wife is expecting a commission check on a job that she referred to her dad’s company (~$700), a final commission check from her old job ($600-$1,000), a final check from the job that laid her off (~$1920), and her first paycheck from her new job(~$1,075). I’m also hoping to receive my company profit sharing (~$550) in September.