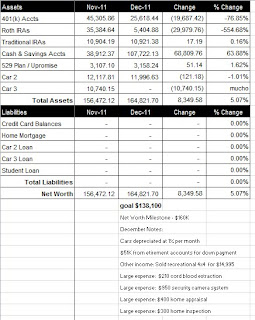

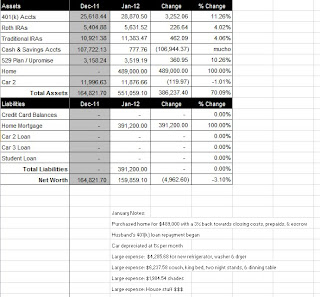

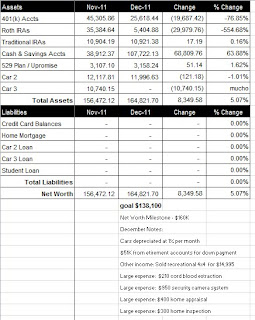

December was an exciting month for us. We have been renting a condo for 2+ years and have been looking for a home as we saved money. After a lot of searching and savings, we found a beautiful 5 bed/3 bath with a pool in a great part of town. Our offer of $489,000, with 3% back towards closing costs, was accepted and escrow is scheduled to close 1/23. Anyways, on to our net worth. We had another great net worth increase of $8,349.58 from last month, to a total of $164,821.70 (click on spreadsheet below).

What Worked

We sold Car 3, our recreational 4×4, for $14,995 in order to provide an influx of cash to furnish our new home. For now this is going into savings, but it will start to flow out of savings once we move in to the new place in January. We were able to deposit $17,095 into savings, plus an addition to $51,000 from our retirement accounts for the down payment.

What Didn’t Work

We contributed a total of $893.96 our retirement accounts, but they decreased $49,649.99 because we raided our retirement accounts for $51,000 to help fund our 20% down payment ($97,800) on our new home.

Next Month

January will be a huge month for us. We’re scheduled to move into our new home and will be spending copious amounts of money to furnish and decorate it. My wife also goes back to work on January 2, so we will begin paying a nanny $225/week to care for our baby boy.

I will be posting a review of our 2011 Financial Goals in a few days.