May was an excellent income month and a large expense month (click on spreadsheet below).

Our total income for May was $11,571.83. In addition to our regular paychecks, I received a third “extra” paycheck this month and my awesome wife earning a quarterly bonus of $2,325 gross ($1,937.89 net). My wife also received $43 in company reimbursements, we received $75 in credit card rewards, and we earned $2.47 in interest income from our online savings account. I want to take a moment to say that we feel very blessed. This income allows us to pay our mortgage, save for retirement, live a comfortable lifestyle, etc. and it is only because of God. We do not deserve it, but pray that we use it to His glory.

Category Archives: Income Statement

April 2012 Income Statement

Things are starting to settle down a bit. April brought an average income month and, thankfully, decreased spending (click on spreadsheet below).

Our total income for April was $7,591.52. Our regular paychecks saw a bit of an increase this month in the form of a 1% raise for me ($704.60/year) and my wife changing her filing status to M2 ($200.15 net increase per check that began her 2nd check of the month). We received $50 in credit card rewards, $43 tax refunds ($41 Fed & $2 State), a $50 gift to our baby’s 529 Plan, and earned $1.77 in interest income from our online savings account.

February 2012 Income Statement

We continued our spending spree in March, albeit at a reduced rate. Our income was fairly typical (click on spreadsheet below).

Our total income for March was $7,484.97. In addition to our regular paychecks, my wife received $131.92 in reimbursements from her company (includes February internet & meal and March internet). We also received $75 in credit card rewards, a $35 rebate for purchasing an energy efficient washer, and earned $1.37 in interest income from our online savings account.

We did a little more shopping in March for our new home and spent a total of $9,560.07. Our spending over the past three months has been shocking: $22,902.72 in January, $14,038.03 in February, and $9,560.04 in March. At least the trend is going in the right direction. Some of the larger one-time expenses in March included $667.63 for ADT security installation, $400 for a security door, and $275 to our tax accountant.

Next month my check will be a smidge larger thanks to a 1% raise that my company provided all employees. This is a good sign as we have not had any raises for 4 years. The only large, non-reoccurring expense planned in April is $850 for a security camera system installation.

February 2012 Income Statement

December 2012 Income Statement

January was a CRAZY expense month and, thankfully, a very good largest income month (click on spreadsheet below).

Our total income for January was $13,358.37, our 4th largest income month ever. In addition to my two regular paychecks, my wife received $632.86 in Paid Family Leave (had a baby via C-section) and $2,586.22 in paychecks from her company. We also received a $2,050 rental deposit refund, $2,588.75 mortgage refund, $1,000 move in gift, $500 hospital refund, $254.24 in credit card rewards, $100 from selling items on craigslist, and a $20 sitter sittercity.com refund. After wiping out our savings for the down payment, we earned $0.02 in interest income from our meger online savings account.

We spent a total of $22,902.72 in January; by far the most money we’ve spent in one month. We expected this to be the case and sold our recreational vehicle and other items to pay for a great deal of it. Some of the substantial outlays include $12,251.68 for furniture, $3,542.51 for household items (for the new house), $1,010 for our nanny (includes some weekend work), $694.31 for home repair/maintenance items, and $685 for 6 months of prepaid 20 year term insurance for wife and me.

The shopping will continue in February, as we have much more “stuff” to buy for our home. I expect that the spending will begin to settle down in March, and it needs to because we cannot sustain our current level of spending for long. Our income has been much higher than normal the past two months, but should return to its normal level in February.

December 2011 Income Statement

December was a big expense month and our largest income month EVER (click on spreadsheet below).

Our total income for December was $25,449.19, by far the best that we have ever had. Most of the money came from selling our recreational 4×4 for $14,995. Even if you subtract out the vehicle sale, we’re still at $10,454.19. With the birth of our baby and our home purchase, I changed my filing status from M1 to M3. As a result, my take home pay increased $59.51 per check. In addition to my two regular paychecks, my wife received $4,683.14 in Paid Family Leave (had a baby via C-section). We also received $131.13 from her PTO payout, $1,638 from selling items on craigslist, $220 in cash for our son’s 529 Plan, and $75 in credit card rewards. We earned $25.76 in interest income from our online savings account.

We spent a total of $7,394.91 in December. Some of the larger expenditures include $210 co-pay cord blood banking, $950 security camera system, $400 for home appraisal and $300 for a home inspection.

January is going to be a busy month as we prepare to move from our rental unit to our new home. There should be a huge spike in our expenses and we fill the home with furniture. In terms of income, January should be a pretty normal month as my wife goes back to work. With my wife heading back to work in January, we will be paying a nanny $900 a month to care for our baby.

November 2011 Income Statement

November was a reasonable expense month and very, very good income month (click on spreadsheet below).

Our total income for November was $12,479.03; our 3rd highest income month since we began tracking our finances in 2007. I received my two regular paychecks and a 3rd “extra” paycheck. My wife received one regular paycheck and $2,404.85 from SDI (just had a baby via C-section). We also received a $50 gift from my parents (deposited to our baby’s 529 Plan), $71.38 in credit card rewards, $75 insurance reimbursement, $20 from a craigslist sale, $18.04 from a credit card settlement, and earned $28.23 in interest income from our online savings account.

We spent a total of $6,831.93 in December, not too bad considering that we earned nearly double that. Some of the larger expenditures include a(nother) $500 co-pay from the hospital for our baby’s delivery and $300.51 in gifts.

December should a decent income month as my wife shifts from SDI to PFL and my filing status is being changed from M1 to M3 to increase my paychecks. Since we completed most of our Christmas shopping done in November, our expenses in December should be very reasonable.

October 2011 Income Statement

October was a reasonable expense month and an above average income month (click on spreadsheet below).

Our total income for October was $8,252.44. In addition to our regular paychecks, we received $1,050 for our new baby. We also sold some items on craigslist for $30, a $50 Chase credit card cash back reward, and earned $26.40 in interest income from our online savings account.

We spent a total of $7,346.87 in October. We actually spent close to budget, if you subtract out $1,845 for cord blood banking and a final $400 payment to our doula. After deducting these one-time expenses, our total expenses were only $5,101.87. This makes me feel a little better about keeping our regular expenses down in October.

November should be another good income month since I receive a 3rd “extra” paycheck. We’ll try to get most of our Christmas shopping done in November, which will inflate our expenses somewhat, but no other large expenses are planned in November.

September 2011 Income Statement

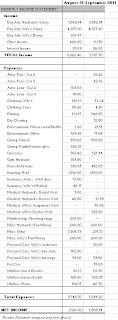

The excitement of our first child’s birth in September overshadowed our pretty normal income and expense month (click on spreadsheet below).

In addition to our regular paychecks, my wife received a $25 reimbursement from her company for internet. We also sold some items on craigslist for $25 and earned $26.82 in interest income from our online savings account.

We ended up spending a total of $5,819.22 in September, including $500 for an insurance co-pay for the hospital and $156.69 for a tux rental. The $1,850 cord blood banking bill and $400 balance due to the doula were not paid this month, but will be paid in October.

I’m not sure what to expect in October. Our net income from my wife’s company will drop because her 10% 401(k) contribution begins in October; at same time we are adding our baby to her insurance, increasing the cost from $75/month to $325/month. My wife will be taking 1 week PTO and then 4 weeks short term disability (full pay). After that, she will need to take 1 week unpaid and then begin Paid Family Leave (55% of your highest gross quarter).

August 2011 Income Statement

August was another very good net income month (3rd in a row over $9K), but also a wild and crazy spending month (click on spreadsheet below).

In addition to our regular paychecks, my wife earned a Q2 2011 bonus $1,006.83 gross ($937.87 net)! These funds will go into savings for now, but are earmarked for a 529 plan for our son. She also received a $25 reimbursement from her company for internet. We earned $170 in credit card cash back rewards and sold a portable A/C unit for $175. My wife scored us a $50 target gift card for giving blood. We also earned $25.09 in interest income from our online savings account.

We gave in to some serious communism this month – $9,022.40 worth to be exact. Some of the bigger ticket items include a $2,715.30 watch for my wife (retails for $4,200), a $532.50 gun for me, a $250 shooting range membership for me, $147.72 for a friend’s wedding shower, $106.46 for a new safe, and much, much more. Hopefully, we got it out of our systems.

September will announce the arrival of our baby boy – we are so excited. With the birth comes a few costs: $400 balance due to doula and $1,850 for cord blood banking. We also need to add the baby to my wife’s insurance so that will increase from $75/month to $325/month. Once the baby is born, my wife will take 3 months off of work using a combination of PTO, short term disability (full pay), Paid Family Leave (55% of your highest gross quarter). As a result, our income will be a bit less until December.

.bmp)