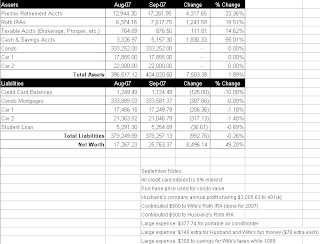

One of our big goals is to buy a house in 5 years and hopefully keep our condo as an investment property.

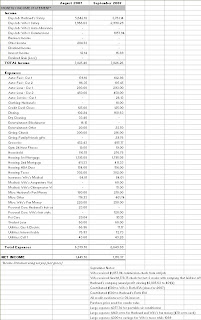

Currently, our monthly condo expenses (mortgages, taxes, HOA fees, and insurance) total $2,697, Unfortunately, that is way more that we can rent our condo for. Therefore, we have decided to focus on paying off our 2nd mortgage ($52,755.81 balance) to help bridge the gap.

Of that $2,697 in total monthly expenses, our 2nd mortgage payment represents $411.33. The interest rate is 8.55%, so only $36 is currently hitting principle each month.

Here’s the plan:

We will use what we consider “extra” money each year to knock down the principle:

$2,000/year from my wife’s two extra paychecks

$3,761.40/year from my two extra paychecks

$1,219.11/year from cashing in 6 days of my vacation

$5,000/year from my wife’s commissions

This would result in $11,980.51 in extra principle payments per year, or $47,922.04 in 4 years, allowing us to pay off the 2nd mortgage by 2011. We may be able to pay it off even sooner because $5,000 is a very conservative number for my wife’s annual commission and we will likely receive annual pay raises.

Once the 2nd is paid off, we will focus on increasing our savings for a house down payment and create a reserve fund for maintenace of both properties. In addition to the $411.33/month we will save after paying off the 2nd, my wife’s car will be paid off in April of 2012, allowing us to bank an extra $450/month. My car will be paid off in June of 2013, helping with our cash flow once we buy a house.

Our condo is next to a major UC school, providing large pool of renters. We hope to be able to rent the unit for $1,800/month. We’d be taking a loss each month initially, but a combination of paying off the 2nd mortgage and tax deductions should help us get within a couple hundred dollars of our rent target.

If we are sucessful in our plan to pay off the 2nd, but find the numbers don’t work out for renting the unit, we will sell the condo and buy a house. In the very least, we will have increased our equity in the condo and saved ourselves a lot of interest.