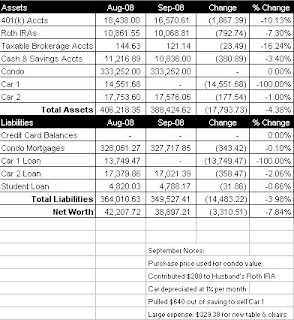

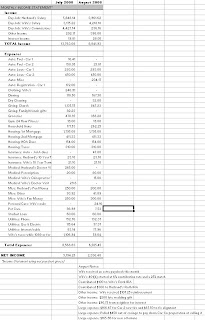

It will be interesting to see how many blogger’s actually saw an increase in their net worth in September. It was a very rough month, and our net worth took a huge $3,310.51 drop to $38,897.21. On the bright side, long term, the depressed stock market should help put our investments that much further ahead when it comes time to retire, since we’re buying everything “on sale” right now.

What worked:

We finally sold Car 1 (my truck). This will allow us to save an additional $293/month in car payments. It was a blessing to sell the truck before the economy gets any worse.

What did not work:

Our retirement accounts (401k’s and Roth IRAs) were hit hard, going down a combined $2,660.13 since last month, even though we contributed a total of $713 in September. We also pulled money out of savings to pay off Car 1, since we sold it at a loss. We’ve slipped off track for hitting our 2008 net worth goal of $47,800 in December. We’re going to work hard to achieve the goal, but if the market remains depressed, we may miss by a couple thousand dollars.

Next month:

October should be a low expense month. We don’t have any large bills due and I will be out of town for 2 weeks so our fuel and food expenses should be less. We’re going to work on stockpiling more cash in the coming months to give us more of a cushion during this economic uncertainty.