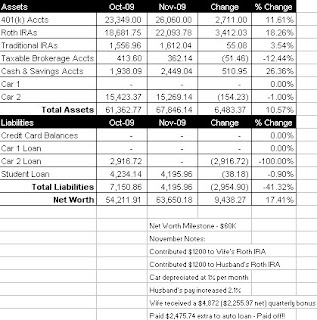

2009 gave us a wild ride and we feel very blessed to have had as great of a year as we did. Below is a table compiling our net worth data for 2009 (click on table to enlarge). We set some goals for ourselves this year and overall, did pretty well. Below are each of our goals and the progress we made.

1) Increase net worth to $75,600

This goal looked doable, but we had a couple of challenges that kept us from hitting this goal. First, we missed our 2008 net worth goal by $5,716.31, so we started 2009 a bit behind. Second, we did not take into account short selling our house. The costs of the short sale and getting a rental unit were set us back a couple of steps. In the end, we got within $7,162.37 of our 2009 net worth goal, with a total net worth of $68,437.63. God willing, we should hit a net worth of $75,600 by February.

2) Wife to get a new job

My wife absolutely nailed this goal. After being laid off, she quickly got a job in the same industry as her last job, and with an even better pay structure and benefits. She received a company car, laptop, monthly phone and internet reimbursements, stock options and 401(k). Go wife!

3) Increase savings account balance to $20,000

Our short sale and moving into a rental unit hurt our chances of hitting this goal, but it still would have be possible, but we decided to pay off our auto loan instead. Our savings account balance at the end of 2009 is $2,492.73, $17,507.27 off our target. Now that the auto loan is paid off, we have $450 extra each month we can put into savings or invest.

4) Max out Roth IRAs ($5,000 each)

I’m surprised we were able to achieve this goal. We made up a lot of ground the last couple of months and were able to get $10,000 total ($5K each) into our Roth IRAs. This is a great feeling.

5) Contributing at least 5% of income to company 401(k)

We blew way past this goal. My wife began contributing 5% in April and increased it to 15% in August. I started 2009 contributing 5% and increased it to 8% in July. Our total retirement contributions (401k & Roth IRA) was $19,437.41, or 15.87% of our gross income. This sets a new benchmark for us.

6) Decrease debt by $8,000

Overkill. If you remove our $326,675.82 mortgage loan (since we short sold), our debt in December 2008 was $20,603.66. Our debt in December 2009 is only $4,148.46, a $16,455.20 reduction. Paying off our auto loan (loan balance in January 2009 was $15,586.49) was the key to smashing this goal.

7) Draft wills

Not done. We’ve decided to hold off on this goal until we have kids.

I will be posting our 2010 goals very soon.