December was a big expense month and our largest income month EVER (click on spreadsheet below).

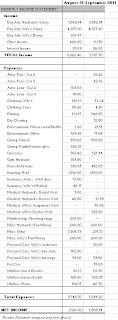

Our total income for December was $25,449.19, by far the best that we have ever had. Most of the money came from selling our recreational 4×4 for $14,995. Even if you subtract out the vehicle sale, we’re still at $10,454.19. With the birth of our baby and our home purchase, I changed my filing status from M1 to M3. As a result, my take home pay increased $59.51 per check. In addition to my two regular paychecks, my wife received $4,683.14 in Paid Family Leave (had a baby via C-section). We also received $131.13 from her PTO payout, $1,638 from selling items on craigslist, $220 in cash for our son’s 529 Plan, and $75 in credit card rewards. We earned $25.76 in interest income from our online savings account.

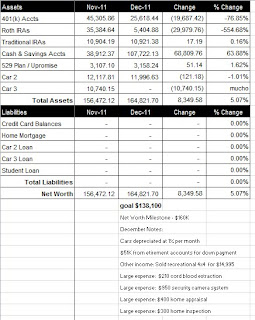

We spent a total of $7,394.91 in December. Some of the larger expenditures include $210 co-pay cord blood banking, $950 security camera system, $400 for home appraisal and $300 for a home inspection.

January is going to be a busy month as we prepare to move from our rental unit to our new home. There should be a huge spike in our expenses and we fill the home with furniture. In terms of income, January should be a pretty normal month as my wife goes back to work. With my wife heading back to work in January, we will be paying a nanny $900 a month to care for our baby.