Below are the 5 goals that we set for ourselves 12 months ago and the results of our efforts to achieve them. Reaching 4 of our 5 goals in this economy feels great. The game changer for us in 2011 was my wife’s new job. She already had a good paying job, but was recruited away in April and given a $20,000 higher annual salary and an opportunity to make larger bonuses each quarter. I am so proud of the success she has enjoyed in her career and feel that her new position was pivotal in reaching our goals this year. I’ll be posting our 2012 goals shortly.

1) Increase net worth to $138,100 SUCCESS

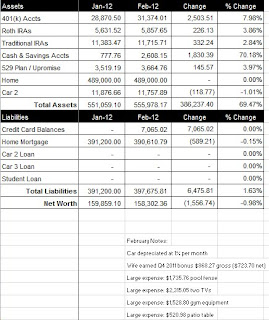

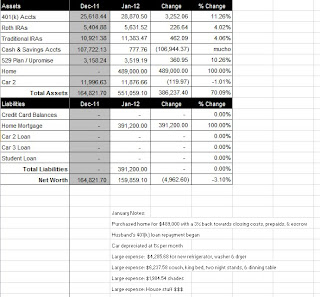

Thanks to a good head start on our 2011 net worth goal (we passed our 2010 goal by $9,600.07), this was relatively easy. In fact, we passed our 2011 net worth goal in April and by July our net worth was over $150,000. Shortly after, however, the stock market began to fluctuate wildly and our net worth took a dive, but we still finished the year with a net worth of $164,821.70, $26,721.70 over our goal of $138,100.

2) Increase savings account balance to $20,000 SUCCESS

We started 2011 with $9,215.82 in savings, but we pulled $3,000 out to pay off our student loan and another $3,000 out to open a 529 Plan for my son. That being said, we still CRUSHED this goal, ending the year with $107,722.13 in savings ($52,696.37 + $51,000 pulled from retirement accounts). The biggest boost to our savings came from selling our recreational 4×4 for $14,995. While it was nice to hit this goal, we will be depleting most of our savings account in the next 30 days to fund our 20% home down payment and to purchase furniture.

3) $100,000 total balance in retirement accounts FAIL

In July 2011, we had over $95,000 in our retirement accounts and it looked like we would surely reach this goal by the end of the year. However, with the market correction, our balance dropped to ~$92,000 by the early December 2011. It was at this time that we raided our retirement accounts ($21,000 loan from 401k and $30,000 withdrawal from Roth IRAs) to help fund our 20% ($97,800) home down payment. So, we ended 2011 with retirement account balances totaling $41,944.70. We contributed $14,280.72 total to our retirement accounts in 2011.

4) Decrease debt by $1,000 SUCCESS

We started 2011 with only $3,041.81 in student loan debt. I’m happy to report that we ended the year with no debt ($0.00)! It is such a great feeling to finally be completely DEBT FREE.

5) Start a family SUCCESS

Accomplishing this goal was the biggest blessing of all. After dealing with some fertility issues, my wife and I were shocked to find out that she was pregnant. In September, after a challenging labor, our healthy baby boy was born and we couldn’t be more happy.