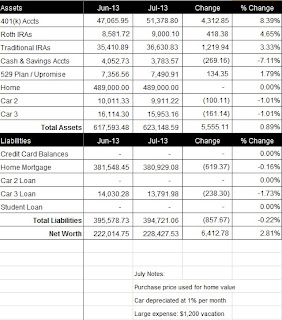

After a down month last month, in July we saw our net worth increase a whopping $6,412.78, to a total of $228,427.53 (click on spreadsheet below).

What Worked

My wife received an $891.92 employer match to her 401(k). We contributed a total of $1,201.96 to our retirement accounts and saw them increase $5,951.17 to $97,009.73 total. We refinanced our auto loan from a 6.5% to 2.29% loan.

What Didn’t Work

We continue to dip into our savings account.

Next Month

My wife may be starting a new job at the end of next month. Stay tuned.