Today we passed the $240,000 net worth milestone! Our net worth is currently $240,095.38.

October 2013 Income Statement

October was an even better income month than last month, which was phenomenal, but it was also a large expense month(see attached spreadsheet).

October 2013 Net Worth Update (+5,439.56)

Our net worth in October increased nicely again. In October, our net worth increased $5,439.56, to a total of $239,359.04 (click on spreadsheet below).

In October, we contributed $1,228.32 to our retirement accounts and saw them increase $4,545.84 to a total of $105,527.58. While we don’t track current market value of our home in the spreadsheet (we use the purchase price), comps in our area are selling for $100K+ more than our purchase price.

–

November should be another good month.

September 2013 Income Statement

September 2013 Net Worth Update (+6,882.47)

Our net worth in September showed good improvement. In September, our net worth increased $6,882.47, to a total of $233,919.48 (click on spreadsheet below).

What Worked

September was such a blessing. We found out that my wife is 4 weeks pregnant! We are so happy to be having a second child. We also passed the retirement savings milestone of $100,000 in total retirement assets! September was my wife’s first full month at her new job, which she loves. In September, we contributed $1,062.76 to our retirement accounts and saw them increase $5,802.02 to a total of $100,981.74. We also tucked away a little more into our son’s 401(k).

What Didn’t Work

–

Next Month

October should be another good month. I receive a 3rd “extra” check and no major expenses are planned.

Retirement Accounts Total Balance Passed $100K

Today our retirement accounts total balance (401k, Roth IRA, & Traditional IRA) passed $100,000.

Our retirement accounts total balance is $100,697.64! This is a major blessing and milestone for us. I’ve always heard the first $100K is the hardest and that it just gets easier. Let’s hope that’s the case.

August 2013 Income Statement

August, in addition to being brutally hot, was an good income month and a huge expense month too (see attached spreadsheet).

September will be interesting. It will be my wife’s first full month at her new company. Plus, she still is due 1 final week of pay from her old company.

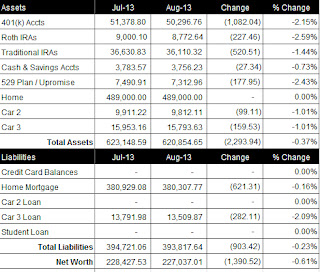

August 2013 Net Worth Update (-1,390.52)

We were doing well in August until the end of the month, then the wheels came off the cart. In August, we saw our net worth decrease a $1,390.52, to a total of $227,037.01 (click on spreadsheet below).

What Worked

My wife began a new job this month making $97K annual salary plus an opportunity to earn $35K+ in bonus each year. The company gives her $600/month auto allowance, a gas card, $100/month for home office, and 20K shares of stock each year. This is a huge blessing to our family.

What Didn’t Work

Sadly, all of our numbers fell this month.

Next Month

September will be my wife’s first full month with her new company. Her large income should really help us towards our goals.

Net Worth Milestone – $230,000

July 2013 Income Statement

July was an average income month and a larger than budget expense month (see attached spreadsheet).

Our total income in July was $8,083.39. In addition to our regular paychecks, my wife received a $25 company reimbursement. We also received $45.36 in credit card cash back rewards and earned $2.71 in interest income from our online savings account.

August will be interesting. My wife will be giving her 2 week notice and does not start her new job until the end of August. Hopefully her current company won’t let her go as soon as she gives notice.