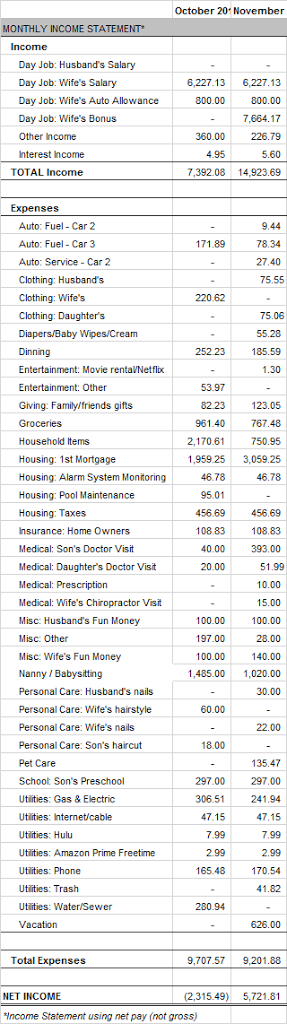

We bought our house in January 2012 for $489,000. It’s a renovated two story 5 bed/3 bath with a good sized pool in a nice, quiet neighborhood. We put 20% down ($97,800) and received 3% from the seller towards closing costs. We scored a good interest rate of 3.75% for a 30 year term. The home has appreciated considerably since we purchased it, with comps in the area valued ~$650,000. Our current mortgage balance is $368,895.

I feel good that we bought at a very fair price (for San Diego County) and locked in a good rate. We would have loved to have secured a 15 year loan, but the monthly payment would have been tight for us. Instead, our plan was to make extra payments to the mortgage principal as funds allow, while having the flexibility of paying the lower payment when necessary.

Over the past three years, we have failed to make progress paying extra to principal. It simply hasn’t been as much of a priority. That changed last month when we made our first extra mortgage payment of $1,100 and we paid an extra $100 this month.

Needless to say, we have some ground to make up. One of our goals for 2015 will be to refocus on accelerating our mortgage payments. To that end, a portion of my wife’s future bonuses will be diverted to the mortgage.