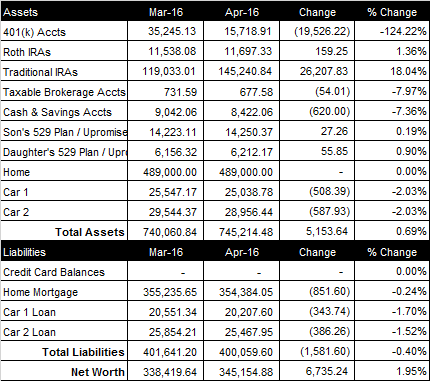

Overall

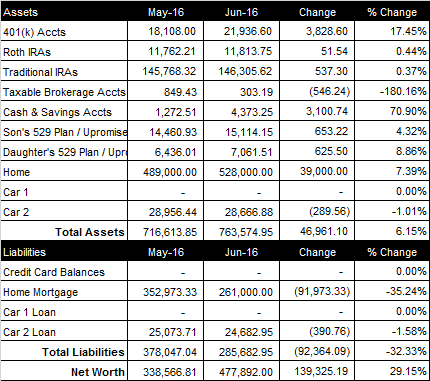

In June, our net worth increased $139,325.19 to a total of $477,892.00 (see spreadsheet screenshot). Most of our increase came from selling our home for $685K, ~$330K more than we owed on it. We were in escrow on a new property but it fell through two days before closing due to a tax lien they had on their property. No worries though, we found a nicer home in a better neighborhood in only two days.

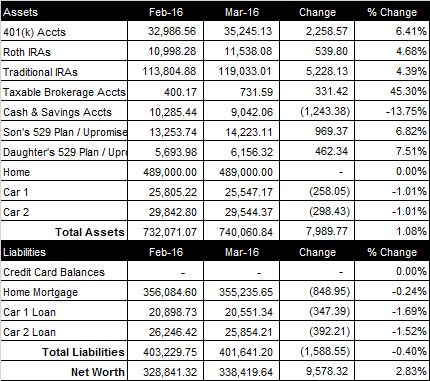

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 10% to my 401(k) and 5% to my wife’s 401(k). My company matches up to $1,000 per year (vested over five years). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited). This month, we contributed $660.27 to my 401(k). My wife contributed $687.50 to her 401(k) and her company deposited another $1,000.00 into her 401(k) for her 5% match and 5% extra “chip in”. We saw the total balance of our retirement accounts increase $4,417.44 from last month to a total of $180,055.97.

Brokerage Account

Currently, our brokerage account consists of one stock (my wife’s old company) that went down $546.24 this month. Our balance is $303.19 on a $2,000.00 in initial investment.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings account balance. It does not include our checking account balance that we use to pay our bills each month. This month our cash and savings accounts increased $3,100.74, bringing the total to $4,373.25. Our savings would have been higher because we kept some cash from the home sale but we used most of it to purchase furniture.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $600 to our son’s 529 Plan and it increased $653.22 from last month to a total balance of $15,114.15. We contributed $600 to our daughter’s 529 Plan and it increased $625.50 over last month to a total balance of $7,061.51.

Home

As I mentioned at the beginning of this post, our housing situation got interesting this month. We sold our house for a huge profit, went into escrow on a new home only to have it fall through, and went into a quick escrow on another home that we will be moving into shortly. We put $267K down (50%) on the $528K home, leaving us with a $261K balance on the 15-year mortgage. We got a newer, larger, nicer home closer to my wife’s family while reducing our debt and switching to a 15-year mortgage:)

Cars

“Car 2” is a 2012 SUV with ~80K miles. When calculating our net worth, we depreciate the vehicle 1% per month. Car 2 has a current loan balance of $24,682.95. I receive $230.13/month as a fixed car reimbursement and $0.22 per mile as a variable reimbursement (to help cover gas, wear and tear, etc.). My wife has a company car for work.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.