We just passed our net worth milestones of $700,000! This years is starting to pick up! We passed our previous net worth milestone of $690,000 in September.

Our net worth is currently $700,319.99. We hope to reach the $710K milestone by November.

We just passed our net worth milestones of $700,000! This years is starting to pick up! We passed our previous net worth milestone of $690,000 in September.

Our net worth is currently $700,319.99. We hope to reach the $710K milestone by November.

August was a good income month and a pretty terrible expense month (see spreadsheet screenshot).

Our total income in August was $13,804.42. In addition to our regular paychecks, I also received a monthly bonus of monthly bonus $1,833.33 gross ($1,071.87 net) and my wife received gift cards from her company worth $350. My wife also received a $1,004.42 auto allowance / mileage reimbursement and I received a $450 auto allowance. We earned $4.17 in interest income from our savings accounts.

This month, our expenses totaled $15,254.81. Big ticket items include $814.42 boat property tax bill, $343 in clothing, and $274 in professional cleaning for our couch.

Next month, my wife should receive her quarterly bonus but we also have the costs of a birthday party to throw for our son and a $609 vehicle registration bill to pay.

Overall

August was good month for our net worth. It increased $7,548.32 from last month to a total of $691,616.71 (see spreadsheet screenshot). Our retirement accounts passed $300K this month. Such a blessing!

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited in March). This month, we contributed $700.72 to her 401(k). We contribute 6% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $340 to my 401(k). The total balance of our retirement accounts increased $5,913.82 from last month to a total of $305,079.29.

Brokerage Account

Currently, our brokerage account consists of four stocks and some cryptocurrency (I prefer to track crypto in the “brokerage account” field rather than “Cash & Savings Accounts”. The total current value is $5,711.01, down $798.95 from last month.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our cash and savings accounts increased $604.55 this month, bringing the total to $8,012.53.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $479.98 from last month to a total balance of $24,710.93. We contributed $0 to our daughter’s 529 Plan and it increased $258.06 from last month to a total balance of $13,262.97.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $220,656.51. We paid $200 extra towards principal this month.

Vehicles

My wife’s 2017 SUV has 35,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $41,651.72 at 2.79%. I have a 2012 sedan with 120K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $5,525.07 at 1.99%. We also have a ski boat with a loan balance of $52,450.63 at 5.24%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

We just passed our net worth milestones of $690,000! We passed our previous net worth milestone of $680,000 in July.

Our net worth is currently $690,101.67 (barely made it, I know) We hope to reach the $700K milestone by October.

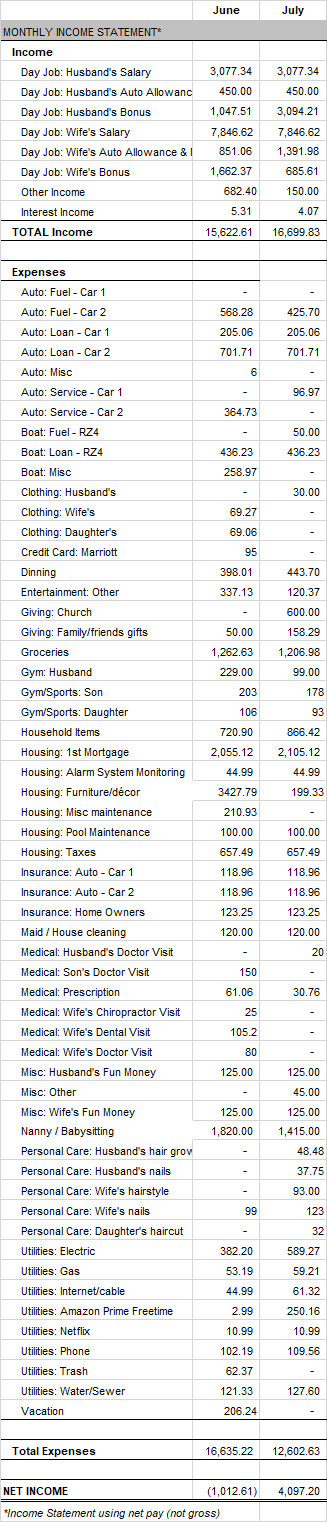

July was a great income month and a very reasonable expense month (see spreadsheet screenshot).

Our total income in July was $16,699.83. In addition to our regular paychecks, I also received a monthly bonus of monthly bonus $5,289.32 gross ($3,094.21 net) and my wife received a special discretionary bonus of $900 gross ($685.61 net) . My wife also received a $1,391.98 auto allowance / mileage reimbursement and I received a $450 auto allowance. We earned $4.07 in interest income from our savings accounts.

This month, our expenses totaled $12,602.63. Big ticket items include $158.29 in gifts, $199.33 in furniture, and $120.37 for entertainment (concert).

Next month my wife my get a very large quarterly bonus and I should receive a decent monthly bonus. Hopefully our expenses can stay low.

Overall

July was a great month for our net worth. It increased $6,972.26 from last month to a total of $684,068.39 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited in March). This month, we contribution of $700.72 to her 401(k). We contribute 6% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $547.54 to my 401(k). The total balance of our retirement accounts increased $6.033.59 from last month to a total of $299,165.47.

Brokerage Account

Currently, our brokerage account consists of four stocks and some cryptocurrency (I prefer to track crypto in the “brokerage account” field rather than “Cash & Savings Accounts”. The total current value is $6,509.96, down $55.77 from last month.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our cash and savings accounts decreased $1,045.93 this month, bringing the total to $7,407.98.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $539.24 from last month to a total balance of $24,230.95. We contributed $0 to our daughter’s 529 Plan and it increased $289.92 from last month to a total balance of $13,004.91.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $222,111.14. We paid $200 extra towards principal this month.

Vehicles

My wife’s 2017 SUV has 35,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $42,221.11 at 2.79%. I have a 2012 sedan with 120K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $5,717.97 at 1.99%. We also have a ski boat with a loan balance of $52,608.65 at 5.24%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

We just passed our net worth milestones of $680,000! We passed our previous net worth milestone of $670,000 in June. The pace of our net worth increase in 2018 has been at a relatively slower pace than last year but we hope to make up ground the 2nd half of the year.

Our net worth is currently $680,982.02. Our retirement accounts led the way to our net worth increased this month.

June was a great income month but and a bad expense month (see spreadsheet screenshot).

Our total income in June was $14,940.21. In addition to our regular paychecks, I received third “extra” paycheck. I also received a monthly bonus of monthly bonus $1,791.67 gross ($1,047.51 net) and my wife received a quarterly bonus of $2,946.00 gross ($1,662.37 net). My wife also received a $851.06 auto allowance / mileage reimbursement and I received a $450 auto allowance. We earned $5.31 in interest income from our savings accounts.

This month, our expenses totaled $16,635.22. Big ticket items include $3,427.79 in appliances, $364.73 in auto repairs, and $206.24 for vacation.

Next month I hope we can do better.

Overall

June was a great month for our net worth. It increased $5,782.73 from last month to a total of $677,096.13 (see spreadsheet screenshot). Interestingly, we passed one million in assets this month (not that it means much lol).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited in March). This month, we contribution of $1,433.02 to her 401(k). We contribute 6% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $337.50 to my 401(k). The total balance of our retirement accounts increased $5,452.66 from last month to a total of $293,131.88.

Brokerage Account

Currently, our brokerage account consists of four stocks and some cryptocurrency (I prefer to track crypto in the “brokerage account” field rather than “Cash & Savings Accounts”. The total current value is $6,565.73, down $1,669.37 from last month, mostly due to the continued cryptocurrency market drop.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our cash and savings accounts increased $5.50 this month, bringing the total to $8,453.91.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $450.35 from last month to a total balance of $23,691.71. We contributed $0 to our daughter’s 529 Plan and it increased $242.13 from last month to a total balance of $12,714.99.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $223,562.29. We paid $200 extra towards principal this month.

Vehicles

My wife’s 2017 SUV has 30,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $42,834.42 at 2.79%. I have a 2012 sedan with 115K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $5,914.32 at 1.99%. We also have a ski boat with a loan balance of $52,856.10 at 5.24%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.

May was an great income month but we spent almost exactly the same about we made, which isn’t good (see spreadsheet screenshot). Our total income in May was $13,221.19. In addition to our regular paychecks, I received a monthly bonus of $916.67 gross ($535.94 net). My wife also received a $1,506.38 auto allowance / mileage reimbursement and I received a $450 auto allowance. We earned $5.16 in interest income from our savings accounts.

This month, our expenses totaled $13,205.18. Big ticket items include $902.35 in misc items, $437.63 in clothing, and $248.78 in medical/prescriptions.

Next month we both should get a few thousand in bonuses and I will receive a 3rd “extra” paycheck.