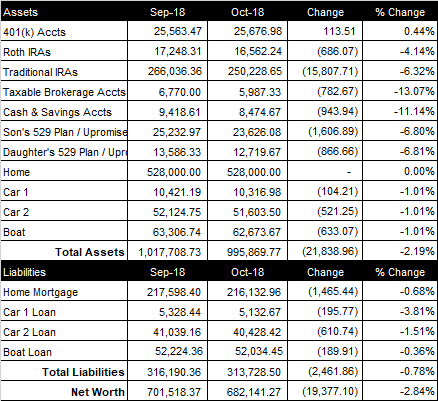

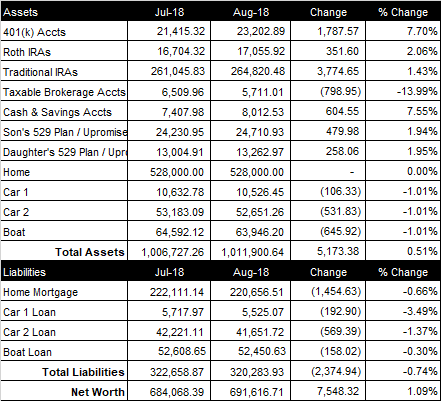

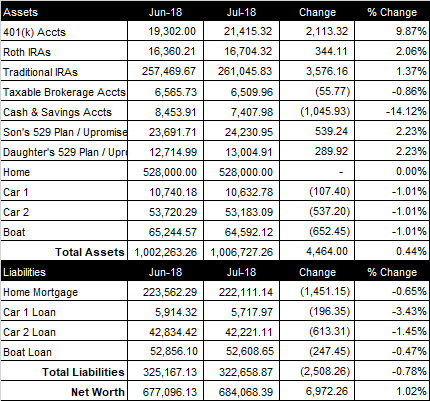

Ouch! October was a tough month for our net worth. It decreased $19,377.10 from last month to a total of $682,141.27 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 5% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution and chips in an additional 5% on top of the match (both 100% vested when deposited in March). This month, we contributed $728.28 to her 401(k). We contribute 6% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $392.50 to my 401(k). The total balance of our retirement accounts decreased $16,380.27 from last month to a total of $292,467.87

Brokerage Account

Currently, our brokerage account consists of four stocks and some cryptocurrency (I prefer to track crypto in the “brokerage account” field rather than “Cash & Savings Accounts”. The total current value is $5,987.33, down $782.67 from last month.

Cash & Savings Accounts

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our cash and savings accounts decreased $943.94 this month, bringing the total to $8,474.67.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it decreased $1,606.89 from last month to a total balance of $23.626.08. We contributed $0 to our daughter’s 529 Plan and it decreased $866.66 from last month to a total balance of $12,719.67.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $216,132.96. We paid $200 extra towards principal this month.

Vehicles

My wife’s 2017 SUV has 40,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $40,428.42 at 2.79%. I have a 2012 sedan with 127K miles. My company gives me a $450/month vehicle allowance and provides me with a gas card. The loan balance on my car is $5,132.67 at 1.99%. We also have a ski boat with a loan balance of $52,034.45 at 5.24%.

Credit Card Balance

We do not currently have a credit card balance that is not paid in full each month.