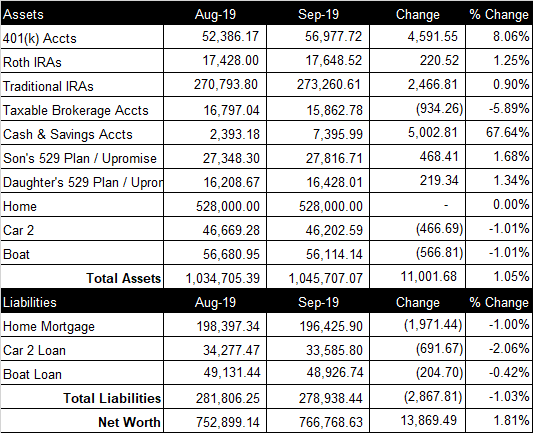

We passed our net worth milestones of $780K this month. We passed our last net worth milestone of $770K this month too! We hope to reach out next milestone of $790K by December.

NET WORTH MILESTONE: $770K

We passed our net worth milestones of $770K this month. We passed our last net worth milestone of $760K in August. We hope to reach out next milestone of $780K by December.

September 2019 Income Statement

In September, we were blessed with an incredible income month and a higher than expected expense month (see spreadsheet screenshot).

Our total income in September was $23,057.55. In addition to our regular paychecks, I received a monthly bonus of $1,950 gross ($1,084.39 net) and my wife received a quarterly bonus $15,000 gross ($9,664.54 net). My wife also received $848.14 in auto allowance / mileage reimbursements and $46.99 in internet reimbursements. We earned $2.81 in interest income from our savings accounts.

This month, our expenses totaled $16,131.03. Honestly, we thought we did better and were surprised to see such a large figure. Big ticket items include $1,107 in doctor bills and prescriptions,$575 in car registration, and $1,800 in tithes.

Next month, we will probably have a more standard income and expense month.

September 2019 Net Worth Update (+13,869.49)

Overall

September was an amazing month for our net worth. Our net worth increased $13,869.49 from last month to a total of $766,768.63 (spreadsheet screenshot). The main reason for the solid month was my wife’s quarterly bonus of $15,000 gross ($9,664.54 net).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution (100% vested when deposited) and chips in an additional 5% on top of the match in March (vests over 3 years). This month, we contributed $1,597.84 to her 401(k). We contribute 10% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $579.62 to my 401(k). The total balance of our retirement accounts increased $7,278.88 from last month to a total of $347,886.85.

Brokerage Account

Currently, our brokerage account consists of a handful of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $15,862.78, down $934.26 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased 5,002.81 this month, to a total of $7,395.99.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $100 to our son’s 529 Plan and it increased $468.41 from last month to a total balance of $27,816.71. We contributed $0 to our daughter’s 529 Plan and it increased $219.34 from last month to a total balance of $16,428.01.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $196,425.90. We paid $660 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with 70,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $33,585.80 at 2.79%. We paid $100 extra towards our auto loan principal this month. We also have a ski boat with a loan balance of $48,926.74 at 5.24%.

Credit Card Balance

All of our credit card debt is paid in full each month.

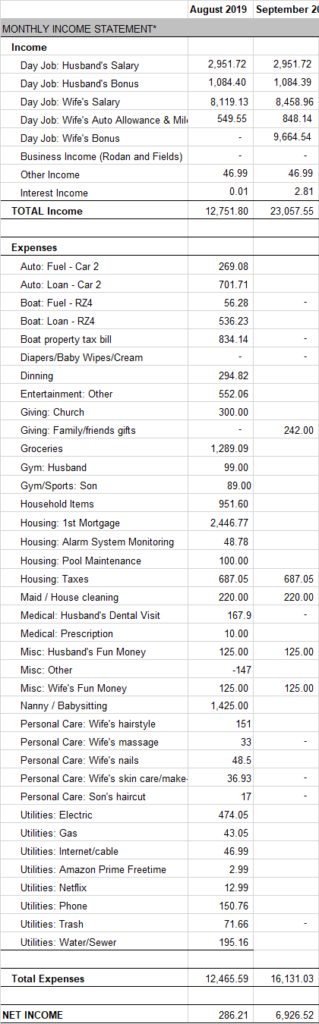

August 2019 Income Statement

In August, we were blessed with a good income month and a low expense compared to what we usually average (see spreadsheet screenshot).

Our total income in August was $12,751.80. In addition to our regular paychecks, I received a monthly bonus of $1,950 gross ($1,084.40 net) and my received $549.55 in auto allowance / mileage reimbursements and $44.99 in internet reimbursements. We earned $0.01 in interest income from our savings accounts.

This month, our expenses totaled $12,465.59. It’s such a blessing to have spent so much less two months in a row! Big ticket items include $834 in boat property tax and $951 in household items.

Next month, my wife should receive a large quarterly bonus that we hope to put into savings.

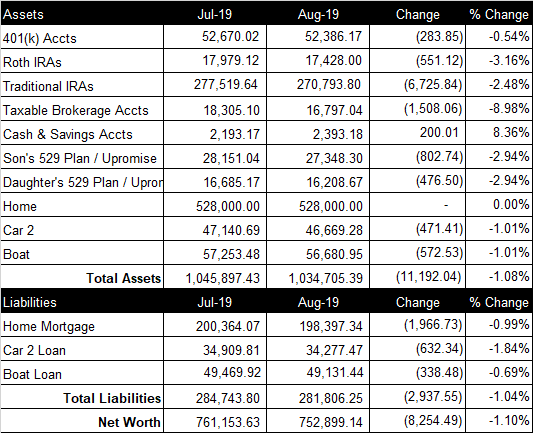

August 2019 Net Worth Update (-8,254.49)

Overall

August was a rough month for our net worth. Our net worth decreased $8,254.49 from last month to a total of $752,899.14 (spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution (100% vested when deposited) and chips in an additional 5% on top of the match in March (vests over 3 years). This month, we contributed $847.84 to her 401(k). We contribute 10% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $579.62 to my 401(k). The total balance of our retirement accounts decreased $7,560.81 from last month to a total of $340,607.97.

Brokerage Account

Currently, our brokerage account consists of a handful of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $16,797.04, down $1,508.06 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased this month, to a total of $2,393.18.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it decreased $802.74 from last month to a total balance of $27,348.30. We contributed $0 to our daughter’s 529 Plan and it decreased $476.50 from last month to a total balance of $16,208.67.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $198,397.34. Our balance is finally below $200,000! We paid $660 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with 65,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $34,277.47 at 2.79%. We also have a ski boat with a loan balance of $49,131.44 at 5.24%. We paid $0 extra towards our boat loan principal this month.

Credit Card Balance

All of our credit card debt is paid in full each month.

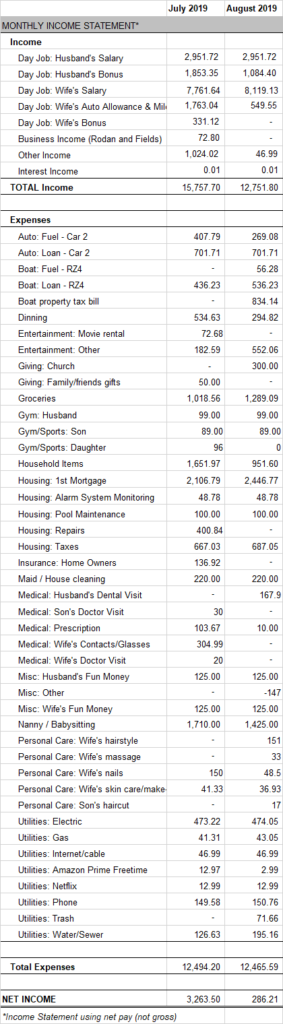

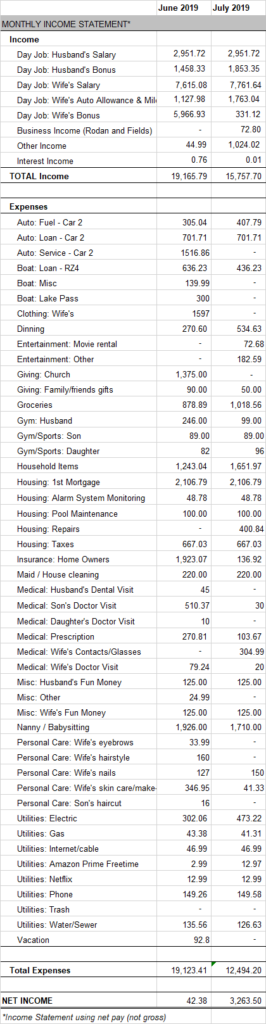

July 2019 Income Statement

July was a good income month and a very low expense (see spreadsheet screenshot).

Our total income in July was $15,757.70. In addition to our regular paychecks, I received a monthly bonus of $3333.33 gross ($1,853.35 net) and my wife received a discretionary bonus of $500 gross ($331.12 net). My wife received $1,763.04 in auto allowance / mileage reimbursements and $44.99 in internet reimbursements. We earned $0.01 in interest income from our savings accounts.

This month, our expenses totaled $12,494.20. A much more reasonable amount compared to the last couple of months! Big ticket items include $252.45 in entertainment, $400 in house maintenance and $305 in eye doctor visits/contacts.

Next month, we hope to keep our expenses down, especially since it will be a lower income month.

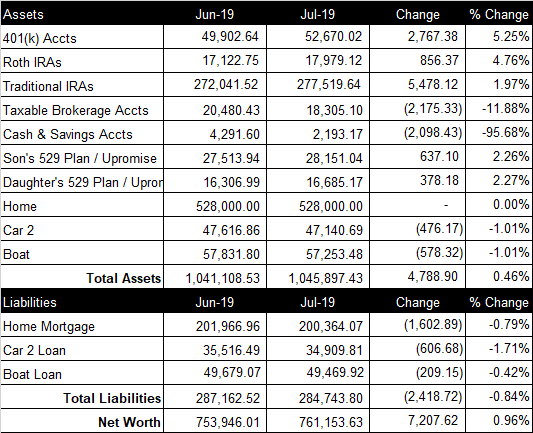

July 2019 Net Worth Update +$11,432.56

Overall

July was a great month for our net worth. Our net worth increased $7,207.62 from last month to a total of $761,153.63 (spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution (100% vested when deposited) and chips in an additional 5% on top of the match in March (vests over 3 years). This month, we contributed $847.84 to her 401(k). We contribute 10% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $717.95 to my 401(k). The total balance of our retirement accounts increased $9,101.87 from last month to a total of $348,168.78.

Brokerage Account

Currently, our brokerage account consists of a handful of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $18,305.10, down $2,175.33 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings dropped this month, to a total of $2,193.17.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $637.10 from last month to a total balance of $28,151.04. We contributed $0 to our daughter’s 529 Plan and it increased $378.18 from last month to a total balance of $16,685.17.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$530K. The current balance of our 15-year, 2.85% mortgage loan is $200,364.07. We paid $300 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with 60,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $34,909.81 at 2.79%. We also have a ski boat with a loan balance of $49,469.92 at 5.24%. We paid $0 extra towards our boat loan principal this month.

Credit Card Balance

All of our credit card debt is paid in full each month. fffffffffffffff

NET WORTH MILESTONE: $760K

We passed our net worth milestones of $760K this month. We passed our last net worth milestone of $750K last month. We hope to reach out next milestone of $70K by August.

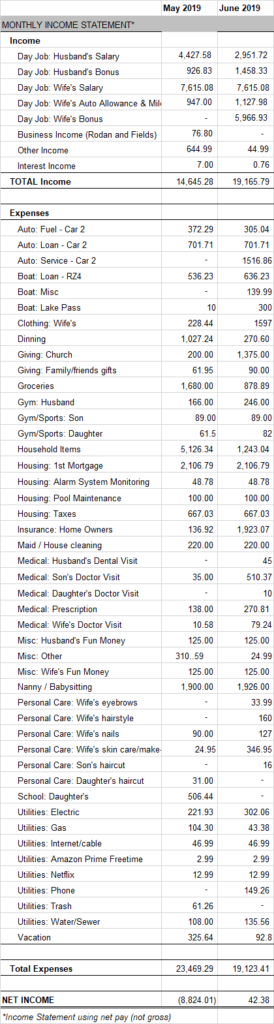

June 2019 Income Statement

June was a good income month, however, our expenses were almost as bad as last month (see spreadsheet screenshot).

Our total income in June was $19,165.79. In addition to our regular paychecks, I received a monthly bonus of $1,458.33 gross ($810.96 net) and my wife received a quarterly bonus of $10,750 gross ($5,966.93 Net). My wife received $1,127.98 in auto allowance / mileage reimbursements and $44.99 in internet reimbursements. We earned $0.76 in interest income from our savings accounts.

This month, our expenses totaled $19,268.10. Not good! Big ticket items include $1,440 purse, $1,786 home insurance for year, and $904 in doctor visits and prescriptions.

Next month we hope to get our spending back in line. It should be a good income month because I receive my quarterly bonus.