Another amazing month! We passed our net worth milestones of $1,020,000. Our net worth is currently $1,022,219. We passed our last net worth milestone of $1,010,000 earlier this month. We hope to reach out next milestone of $1,030,000 in September.

NET WORTH MILESTONE: $1,010,000

We passed our net worth milestones of $1,010,000. Our net worth is currently $1,013,899. We passed our last net worth milestone of $1,000,000 earlier this month. We hope to reach out next milestone of $1,020,000 in September.

NET WORTH MILESTONE: $1,000,000!

We passed our net worth milestones of $1,000,000! I started tracking our net worth in 2007 when we had a negative worth. 13 years later, a snapshot of our finances look like this:

- $465K in retirement savings

- $82K in brokerage accounts & cash

- $53K saved for our kids’ college (age 8 and 6)

- Paid off 2017 SUV

- $355K in home equity (actually $463K equity using current comps instead of our $528K purchase price)

Our net worth is currently $1,001,678.16, making us officially millionaires:) We passed our last net worth milestone of $990K last month. We hope to reach out next milestone of $1,010K in September.

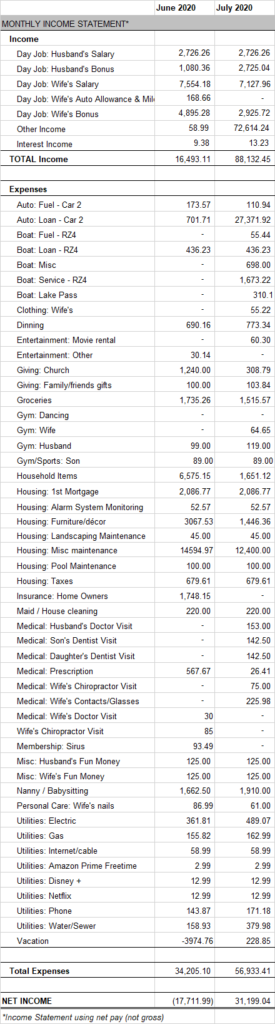

July 2020 Income Statement

In July, we had our best income month ever! As I mentioned in our June net worth update, wife’s company had been restructuring and she accepted the severance package because she found a new position with another company making a 10% higher salary.

Our total income in July was $88,132.45! In addition to our regular paychecks, I received a monthly and quarterly bonus of $4,964.00 gross ($2,725.04 net). More importantly, my wife’s received a $72,614.24 severance/cashed out vacation check plus an unexpected $4,400 gross ($2,925.72 net) bonus from her old company! Plus, we earned $13.23 in interest income from our savings accounts.

This month, our expenses totaled $56,933.41! Wow, that was hard to type lol. Large expenses included $27,371.92 to pay off Car 2, $12,400 in in home improvements, $1,673.22 boat repair and $1,446.36 in furniture. Next month, my wife should be able to cash out her stock options from her old company (~$30K).

NET WORTH MILESTONE: $990K

We passed our net worth milestones of $990K! Our net worth is currently $991,163. We passed our last net worth milestone of $980K earlier this month. We hope to reach out next milestone of $1,000K in August. Almost officially millionaires!

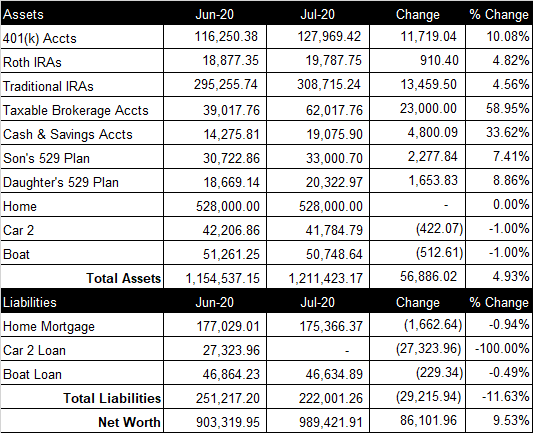

July 2020 Net Worth Update (+$87,101.96)

Overall

July was one of the best months for our net worth. We passed our net worth milestones of $910K-980K this month. Our net worth increased $87,101.96 from last month to a total of $990,421.91 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 8% to my wife’s 401(k). My wife’s company matches up to 6% of her 401(K) contribution and chips in an additional 3% on top of the match at the end of the year (vests over 5 years). This month, we contributed $4,486.30 to her 401(k). We contribute 11% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $969.12 to my 401(k). The total balance of our retirement accounts increased $26,088.94 from last month to a total of $456,472.41.

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $62,017.76, up $23,000 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $4,800.09 this month to a total of $19,075.90.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it increased $2,277.84 from last month to a total balance of $33,000.70. We contributed $0 to our daughter’s 529 Plan and it increased $1,653.83 from last month to a total balance of $20,322.97.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$630K. The current balance of our 15-year, 2.875% mortgage loan is $175,366.37. We paid $300 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with ~80,000 miles. We paid off the load balance on my wife’s car ($27,323.96). She will be getting a company car in the coming weeks and we plan to keep the SUV as an extra vehicle. We also have a ski boat with a loan balance of $46,634.89 at 5.24%.

Credit Card Balance

All of our credit card debt is paid in full each month.

NET WORTH MILESTONE: $980K (ACTUALLY $910K-$980K)

What a crazy year! We passed our net worth milestones of $910K-980K (yes, $70K+ increase) this month! Our net worth is currently $980,077. We passed our last net worth milestone of $900K last month. What a blessing! We hope to reach out next milestone of $990K next month.

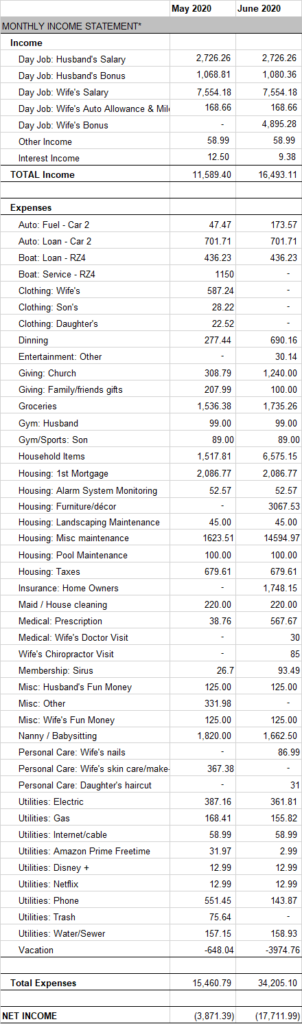

June 2020 Income Statement

In June, we had an amazing income month but we also had a huge expense month (see spreadsheet screenshot).

Our total income in June was $16,493.11. In addition to our regular paychecks, I received a monthly bonus of $1,968.00 gross ($1,080.36 net) and my wife received a quarterly bonus of $9,375 gross ($4,895.28 net). My wife also received a $168.66 auto allowance / mileage reimbursements, and $58.99 in internet reimbursements. We also earned $9.38 in interest income from our savings accounts.

This month, our expenses totaled $34,205.10. Absolutely crazy, I know. We’ve been doing a number of improvements to our home. Large expenses included $14,594.97 in home improvements, $3,067.53 in furniture and $6,575.15 in household items.

My wife separated from her company in mid June and started a new job at the end of June. We thought she would receive a large payout from her old company in June but it looks like it will arrive in July. She should receive a severance (~$95K), cashing out stock options (~$30K) and cashing out vacation time (~$11K).

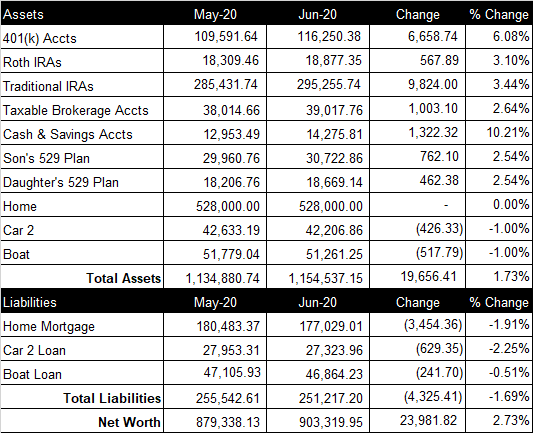

June 2020 Net Worth Update (+$23,981.82)

Overall

June was another outstanding month for our net worth. Our net worth increased $23,981.82 from last month to a total of $903,319.95 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 8% to my wife’s 401(k). My wife’s company matches up to 5% of her 401(K) contribution (100% vested when deposited) and chips in an additional 5% on top of the match in March. This month, we contributed $1,474.83 to her 401(k). We contribute 11% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $639.56 to my 401(k). The total balance of our retirement accounts increased $22,472.00 from last month to a total of $430,383.47.

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). The total current value is $39,017.76, up $1,003.10 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $1,322.32 this month to a total of $14,275.81.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $650 to our son’s 529 Plan and it increased $762.10 from last month to a total balance of $30,722.86. We contributed $650 to our daughter’s 529 Plan and it increased $462.38 from last month to a total balance of $18,669.14.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$580K. The current balance of our 15-year, 2.875% mortgage loan is $177,029.01. We paid $2,100 extra towards our home mortgage principal this month.

Vehicles

My company provides me a vehicle and gas card. My wife has a 2017 SUV with ~80,000 miles. Her company gives her $300/month auto allowance and $0.53/mile reimbursement. The loan balance on my wife’s car is $27,323.96 at 2.79%. We paid $0 extra towards our auto loan principal this month. We also have a ski boat with a loan balance of $46,864.23 at 5.24%.

Credit Card Balance

All of our credit card debt is paid in full each month.

NET WORTH MILESTONE: $900K (actually $860K-$900)

I’m behind a month on our net worth milestones and there’s been a lot of activity. We passed our net worth milestones of $860K and $870K in May and our milestones of $880K, $890K and $900K this month! Our net worth is currently $901,810. We passed our last net worth milestone of $850K in Feb. We hope to reach out next milestone of $910K in August.