Overall

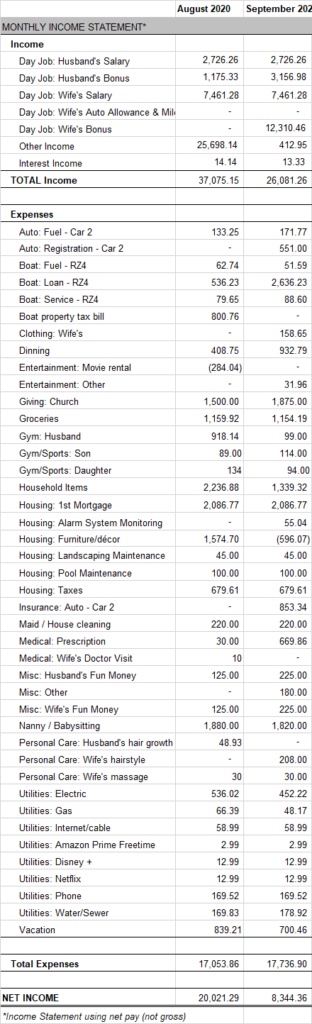

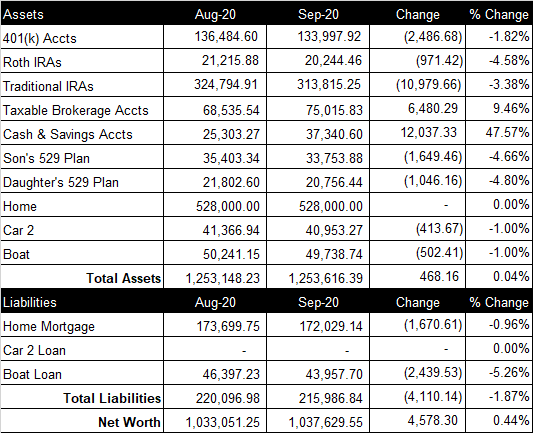

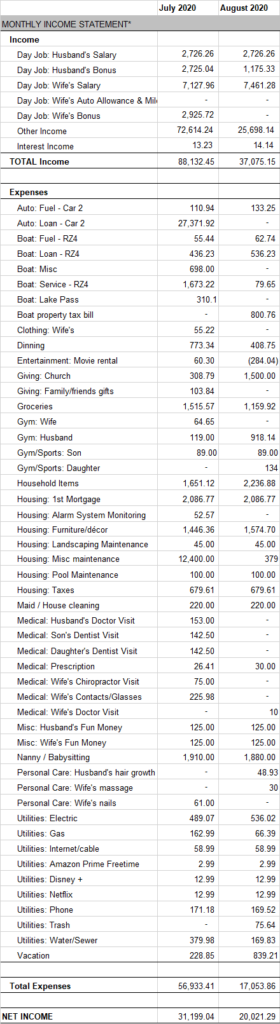

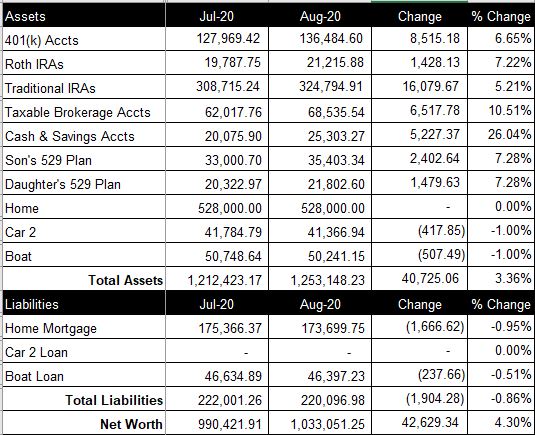

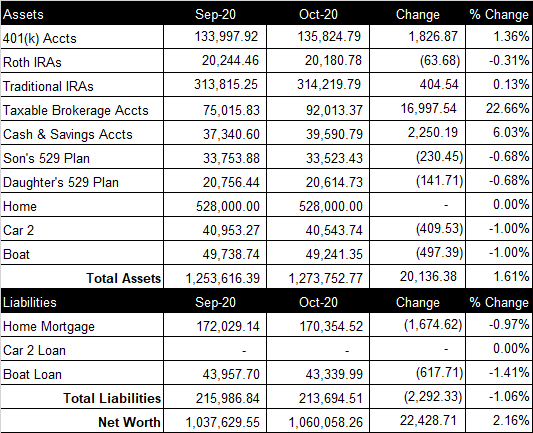

In October, we passed our net worth milestones of $1,050K, $1,060K, and $1,070K, although we ended the month below $1,070K. The growth rate of our net worth has been amazing this year. We are averaging $24K increases every month. It feels like the stock market is due for a major correction in the next couple of years but in the meantime, we’ll keep enjoying the returns. Our net worth increased $22,428.71 from last month to a total of $1,060,058.26 (see spreadsheet screenshot).

Retirement Accounts

Our retirement accounts are comprised of our 401(k)s, our Roth IRAs and our Traditional IRAs. We contribute 7% to my wife’s 401(k). My wife’s company matches up to 6% of her 401(K) contribution and chips in an additional 3% on top of the match at the end of the year (vests over 5 years). This month, we contributed $1,015.38 to her 401(k). We contribute 11% to my 401(k) and my company matches up to 4% and deposits the match in March (100% vested when deposited). This month, we contributed $1,118.87 to my 401(k). The total balance of our retirement accounts increased $2,167.73 from last month to a total of $470,225.36.

Brokerage Account

Currently, our brokerage account consists of stocks and cryptocurrency (I prefer to track crypto in the “Brokerage Accounts” field rather than “Cash & Savings Accounts”). Our cryptocurrencies have been on an upward trend lately. The total current value is $92,013.37, up $16,997.54 from last month.

Cash & Savings Account

Cash and savings accounts consists of a small sum of cash at home and our online savings accounts balance. It does not include our checking account balance that we use to pay our bills each month. Our savings increased $2,250.19 this month to a total of $39,590.79.

College Savings Accounts

Our kids have 529 Plans through Vanguard. This month, we contributed $0 to our son’s 529 Plan and it decreased $230.45 from last month to a total balance of $33,523.43. We contributed $0 to our daughter’s 529 Plan and it decreased $141.71 from last month to a total balance of $20,614.73.

Home

We use the $528K purchase price that we paid in July 2016 for our home value. Current comps in the area are ~$675K. The current balance of our 15-year, 2.875% mortgage loan is $170,354.52. We paid $300 extra towards our home mortgage principal this month.

Vehicles

My wife and I both have company vehicles and gas cards. We also own a 2017 SUV with ~80,000 miles. In addition, we have a ski boat with a loan balance of $43,339.99 at 5.24%. We paid $300 extra to our boat loan this month.

Credit Card Balance

All of our credit card debt is paid in full each month.